This post was created in partnership with CPF Board. All views and opinions expressed in this article are Beansprout’s objective and professional opinions.

You’d think that with a career in finance, retirement would have been one of my top priorities.

But like many people, I found myself focused on more immediate needs: paying off the mortgage, raising two kids, and setting aside funds for their education.

Of course, I did the responsible basics – living within my means, saving, investing, and topping up to my CPF whenever I could. But I didn’t approach retirement in a structured, goal-driven way until recently.

Now, with just 3 years to go before I turn 55, that milestone is starting to feel real. My CPF Special Account (SA) will be closed, and my savings transferred to my Retirement Account (RA).

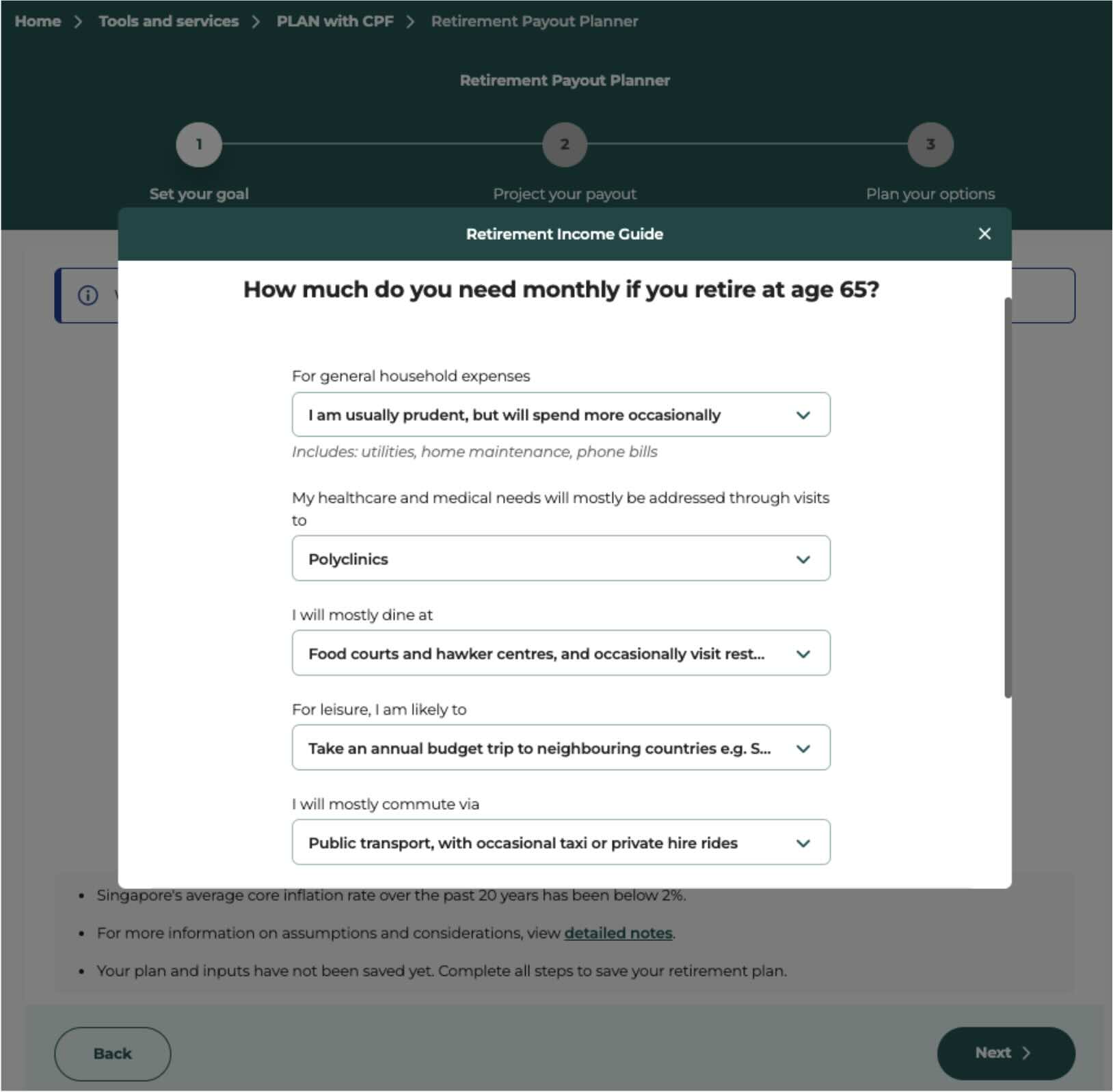

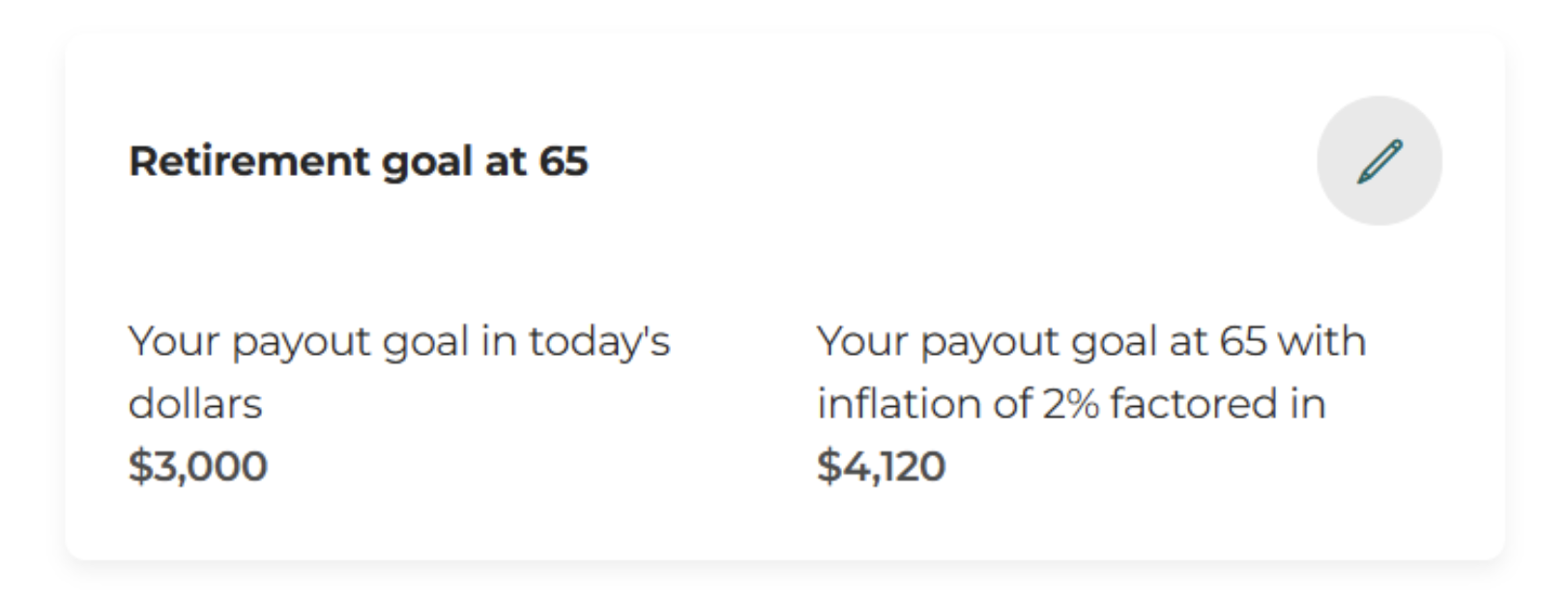

To estimate how much I need for retirement, I relied on online calculators that were often generic, and did not account for my future needs and lifestyle.

I also had my own spreadsheet where I broadly assumed the numbers, but adjusting for inflation, unexpected expenses, and life changes only added to the complexity.

With so much information floating around, I often felt overwhelmed and frustrated, because it wasn’t easy to pin down anything concrete.

Then I came across the Retirement Payout Planner by CPF Board.

I was curious to see how it would compare with the rough estimates I’ve been making on my own, since it pulls from my actual CPF balances and uses assumptions tailored to the Singapore context.

Finally, I might get clarity to the nagging question: will my current CPF savings be enough for retirement?

What is the Retirement Payout Planner?

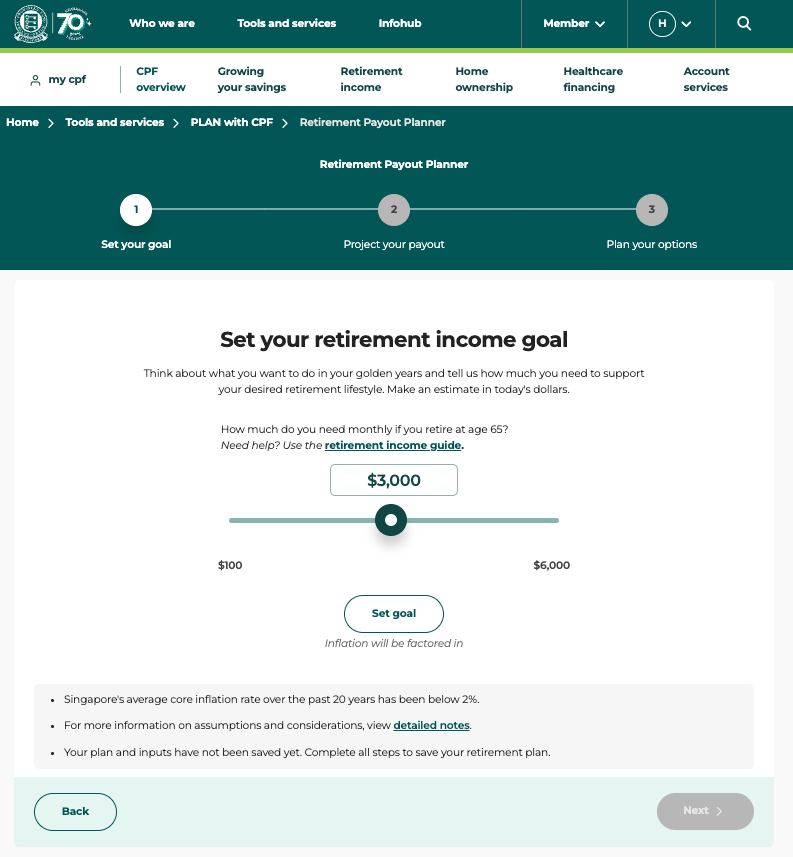

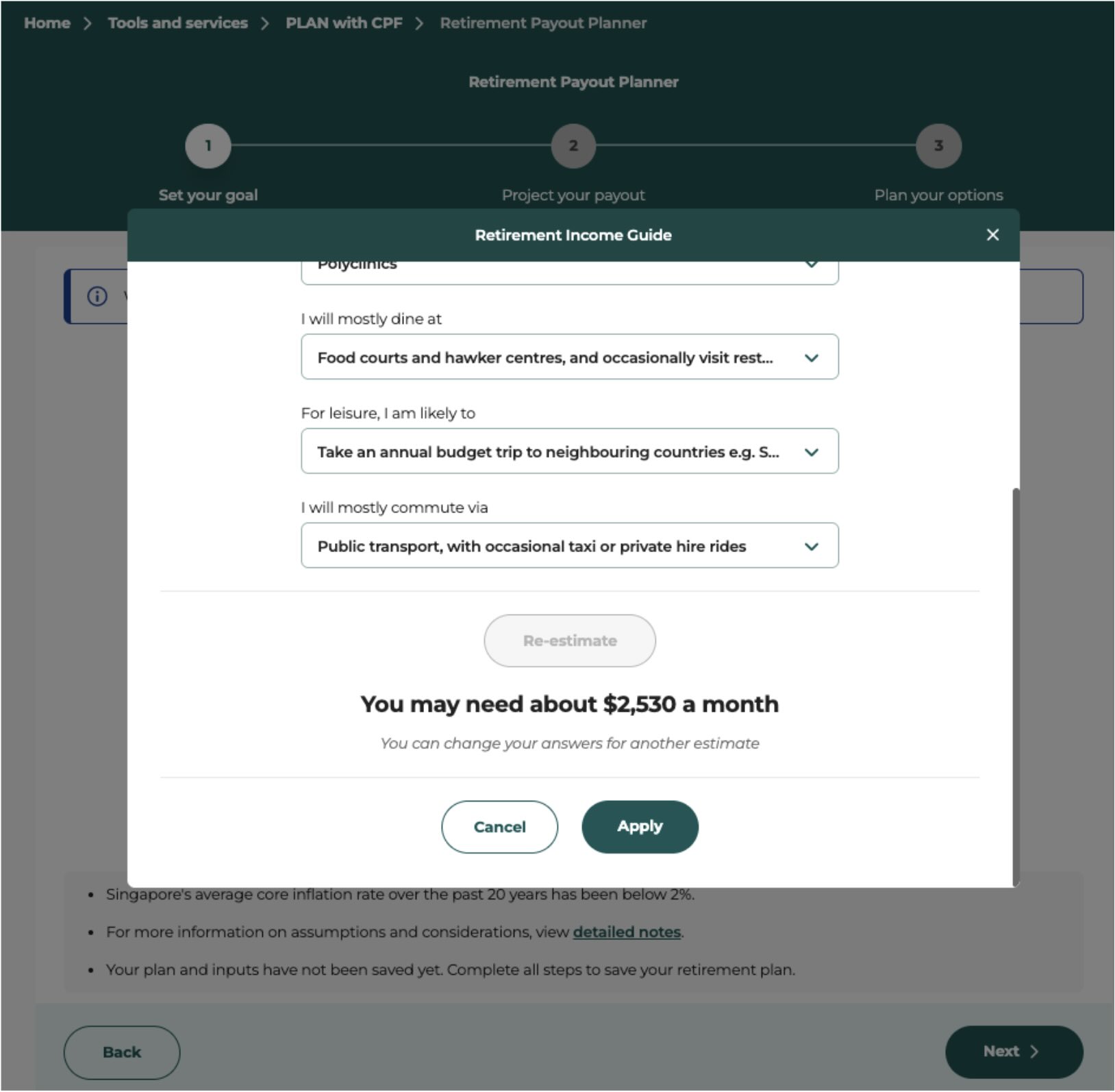

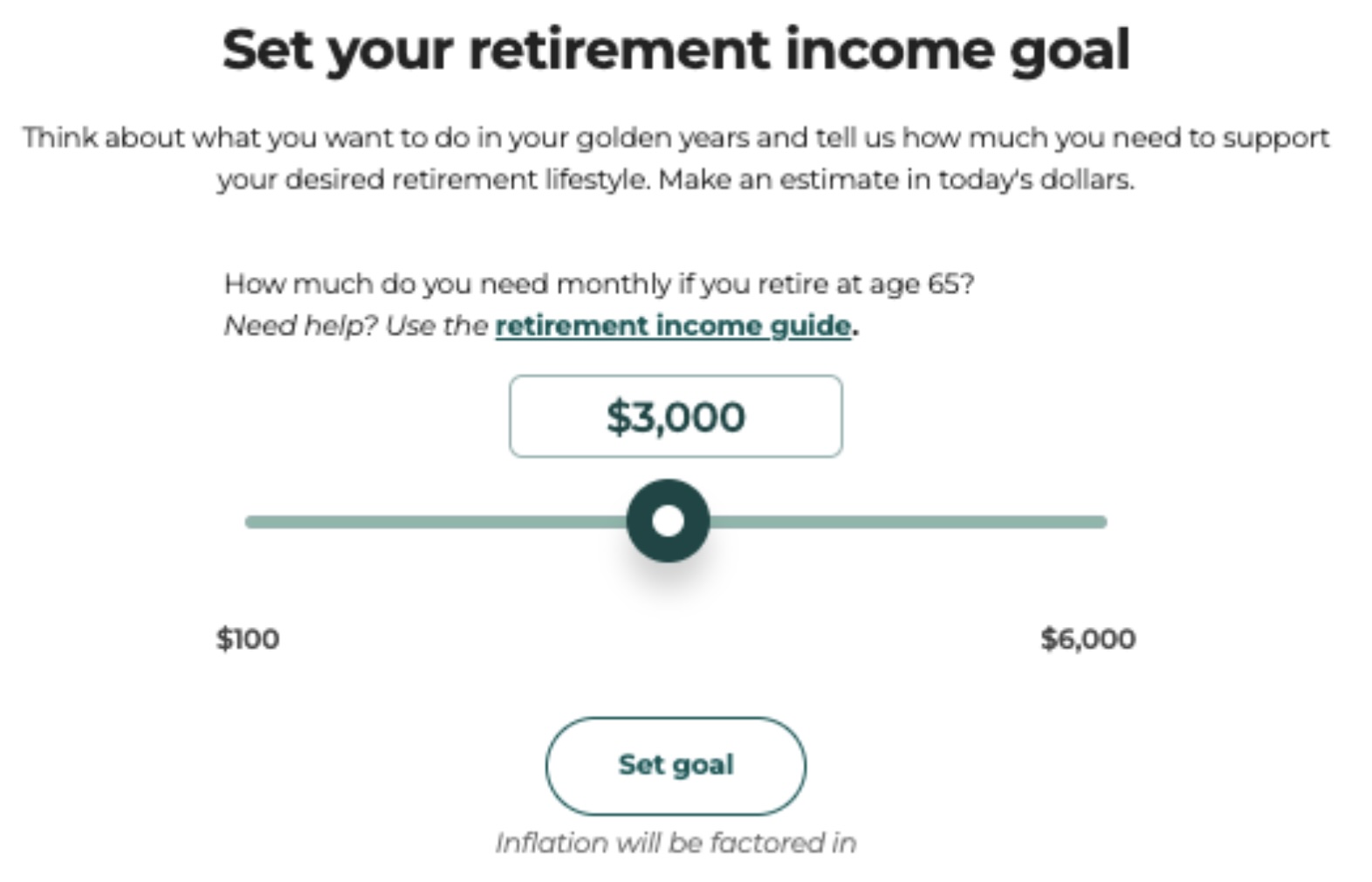

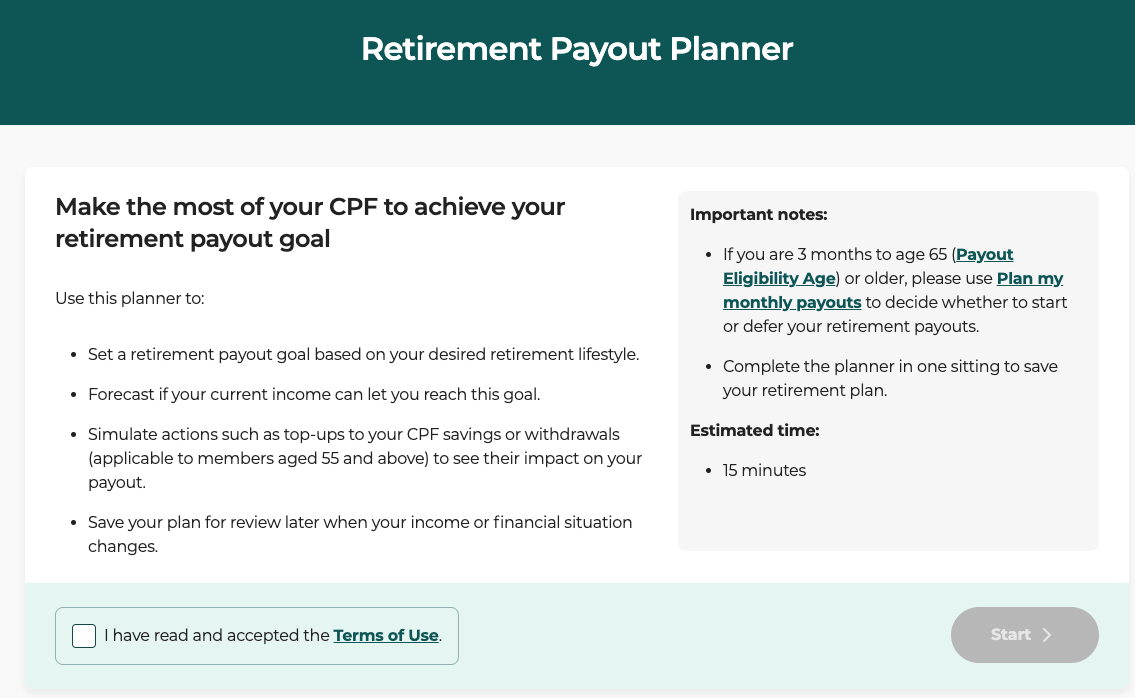

The Retirement Payout Planner helps you make the most of your CPF to achieve your retirement payout goal.

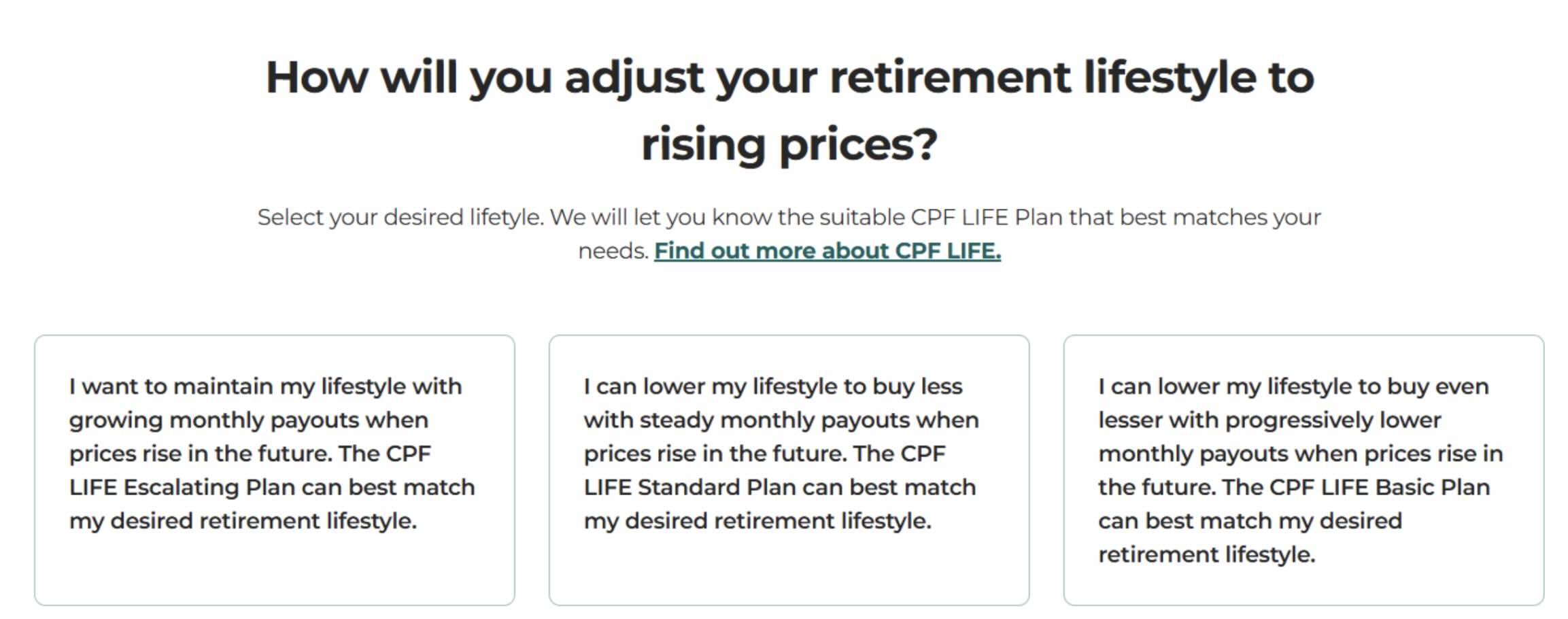

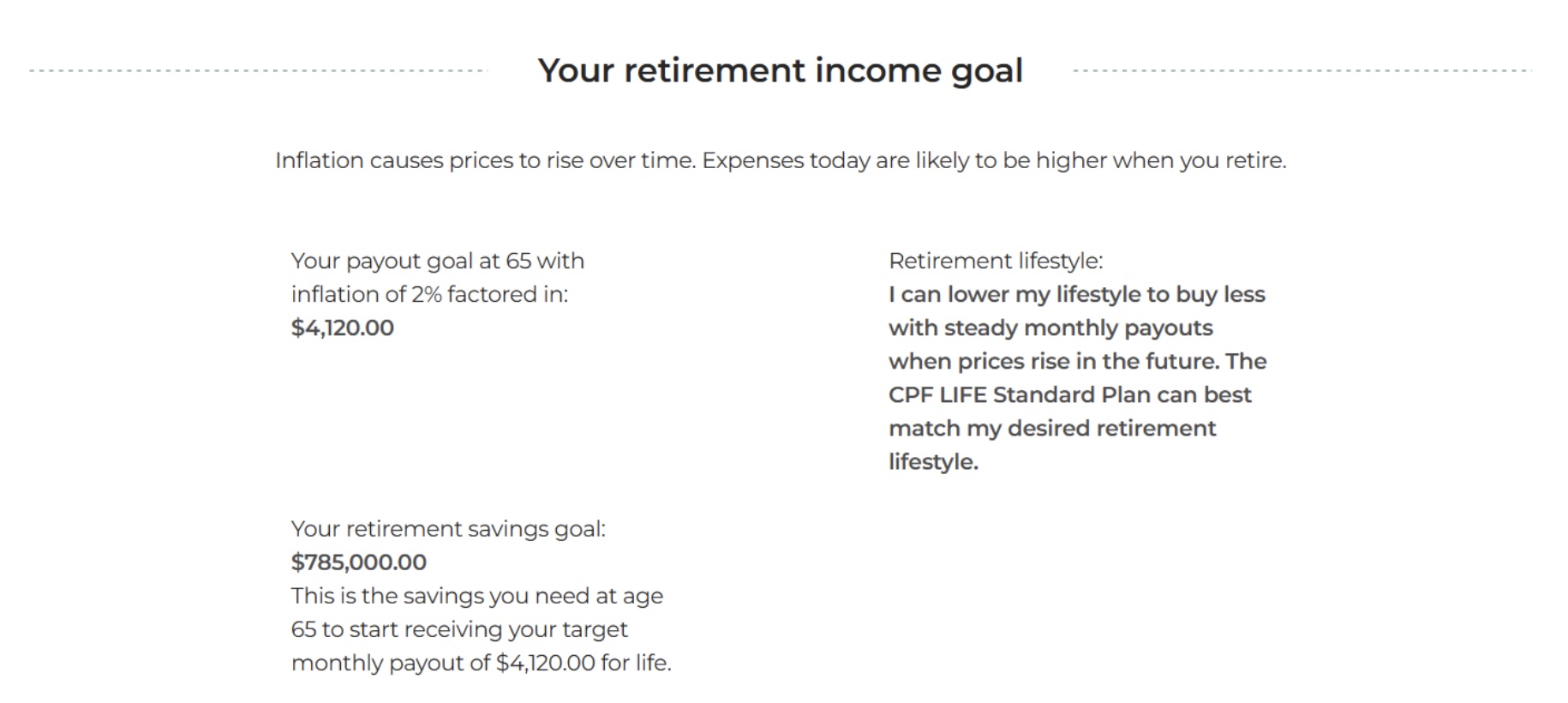

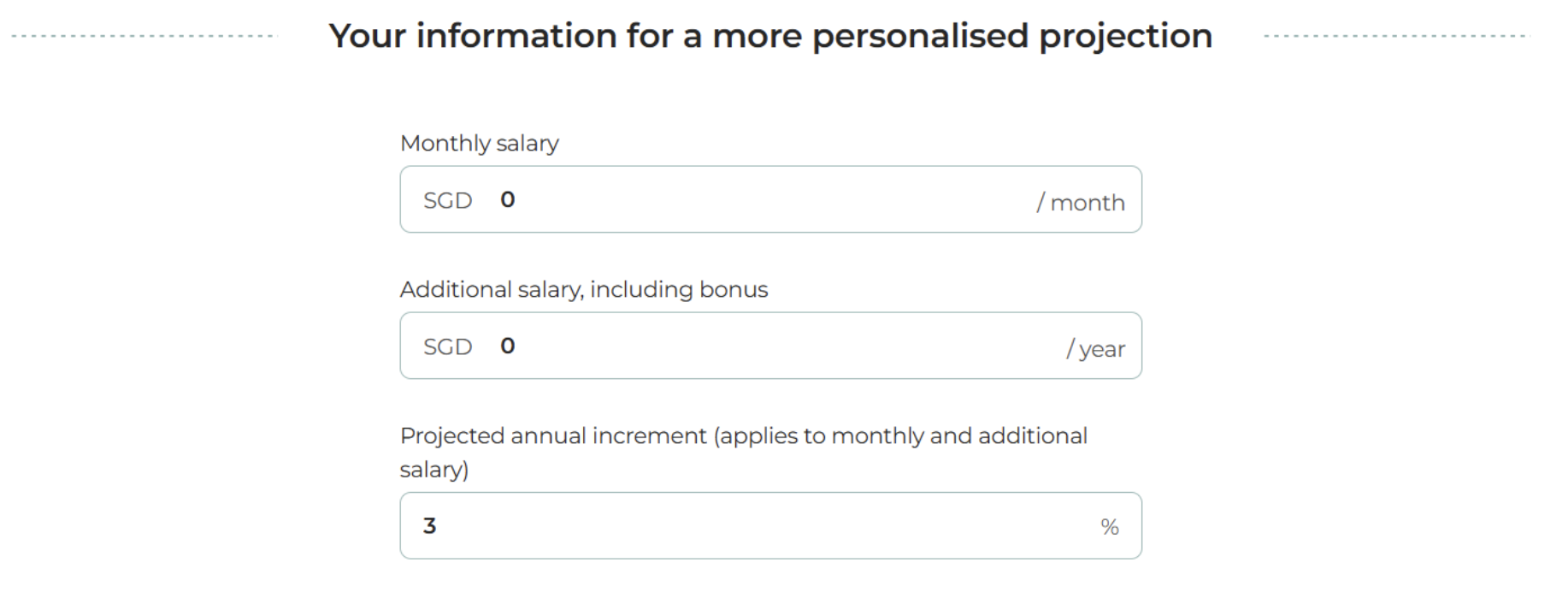

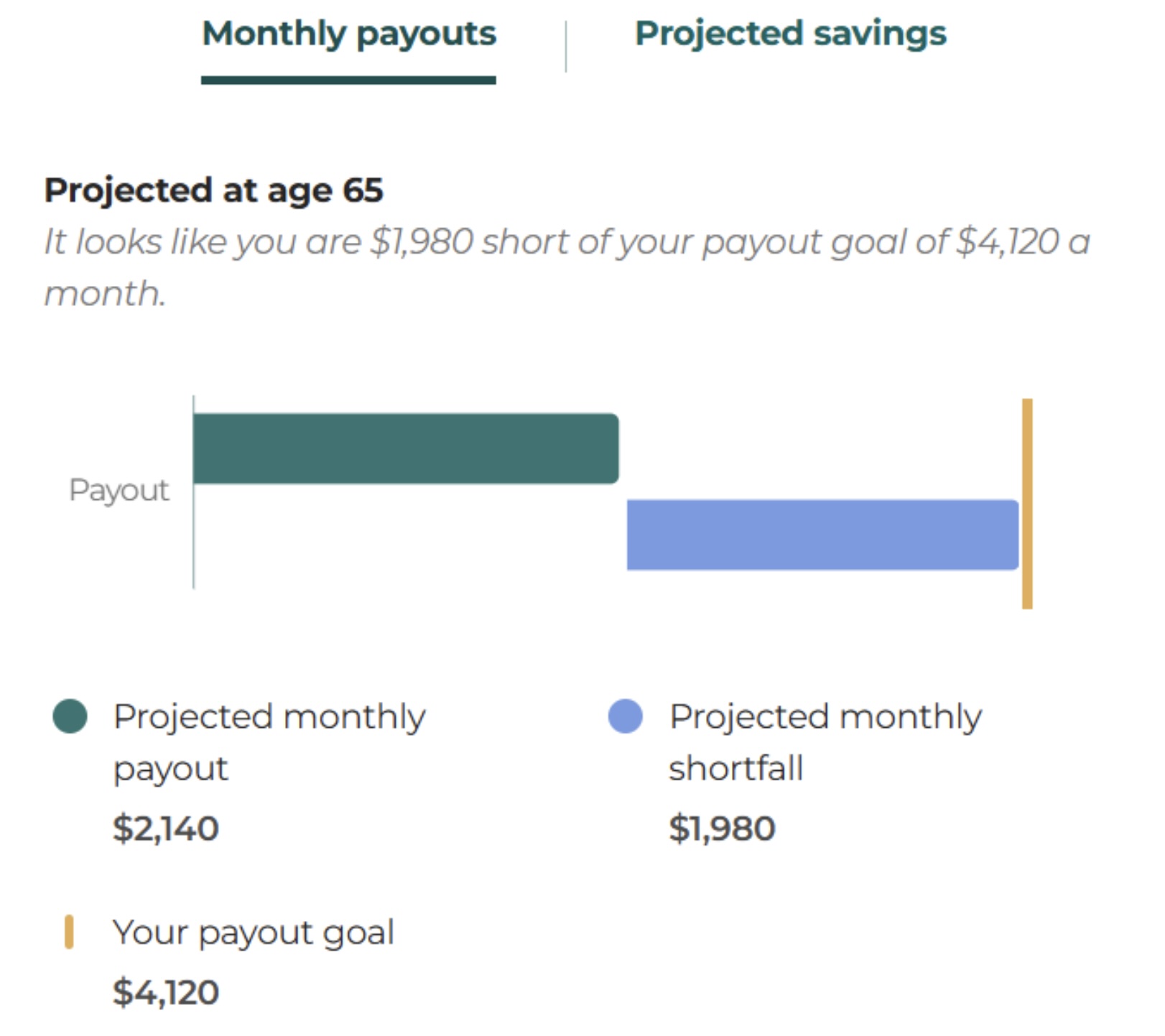

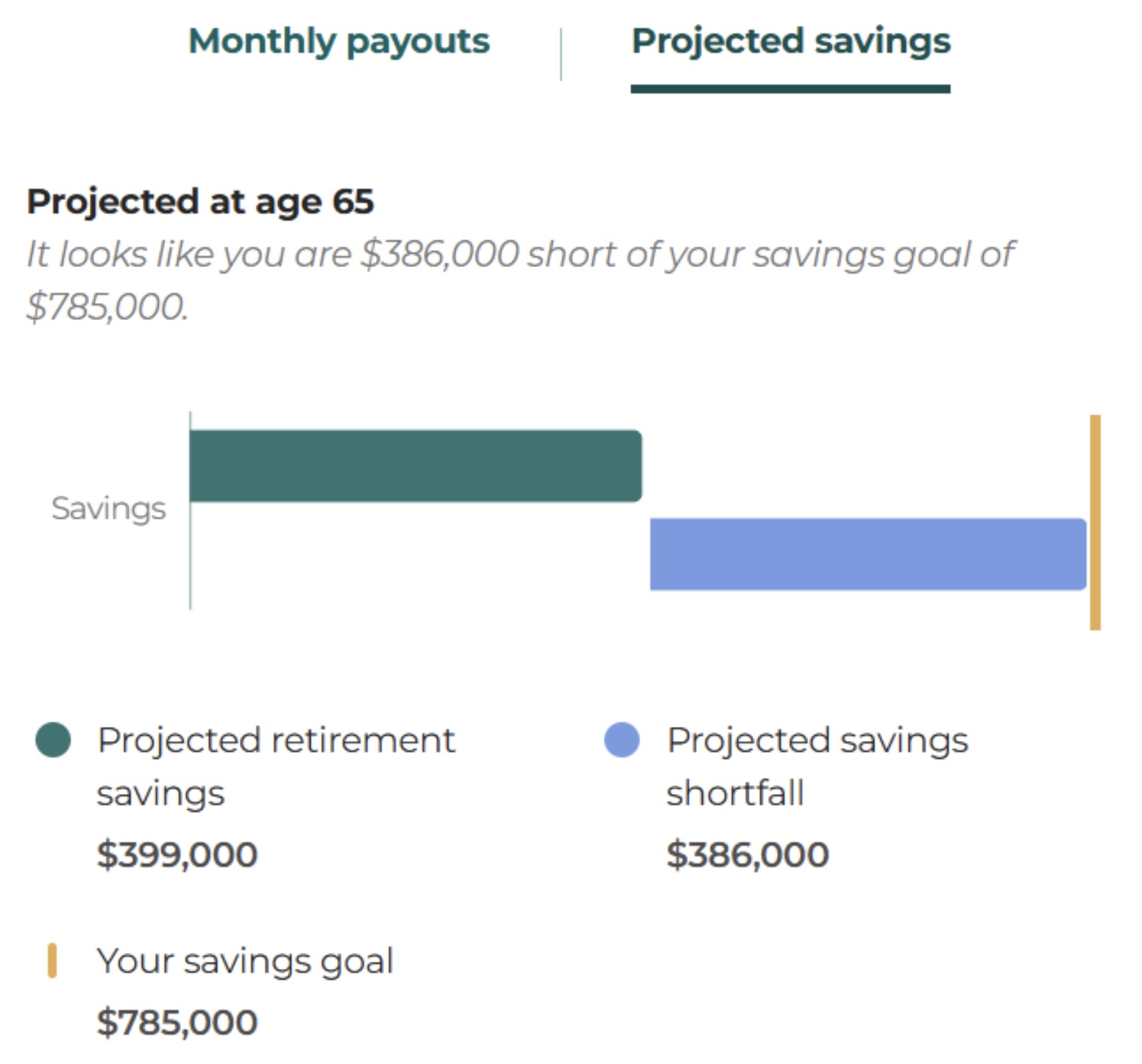

This online tool allows you to set your retirement payout goal based on your desired retirement lifestyle and projects your payouts at age 65, with CPF contributions factored in.

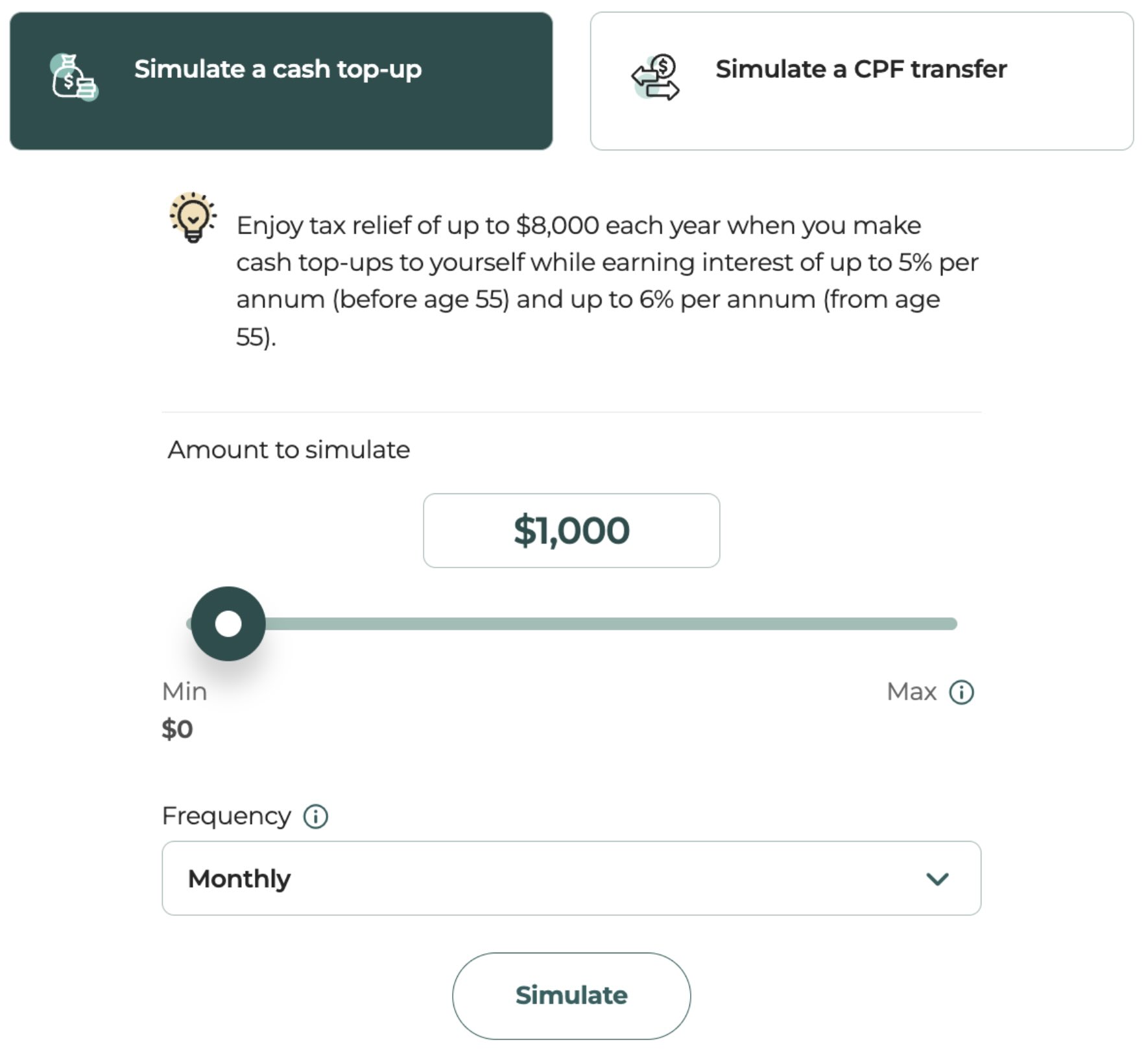

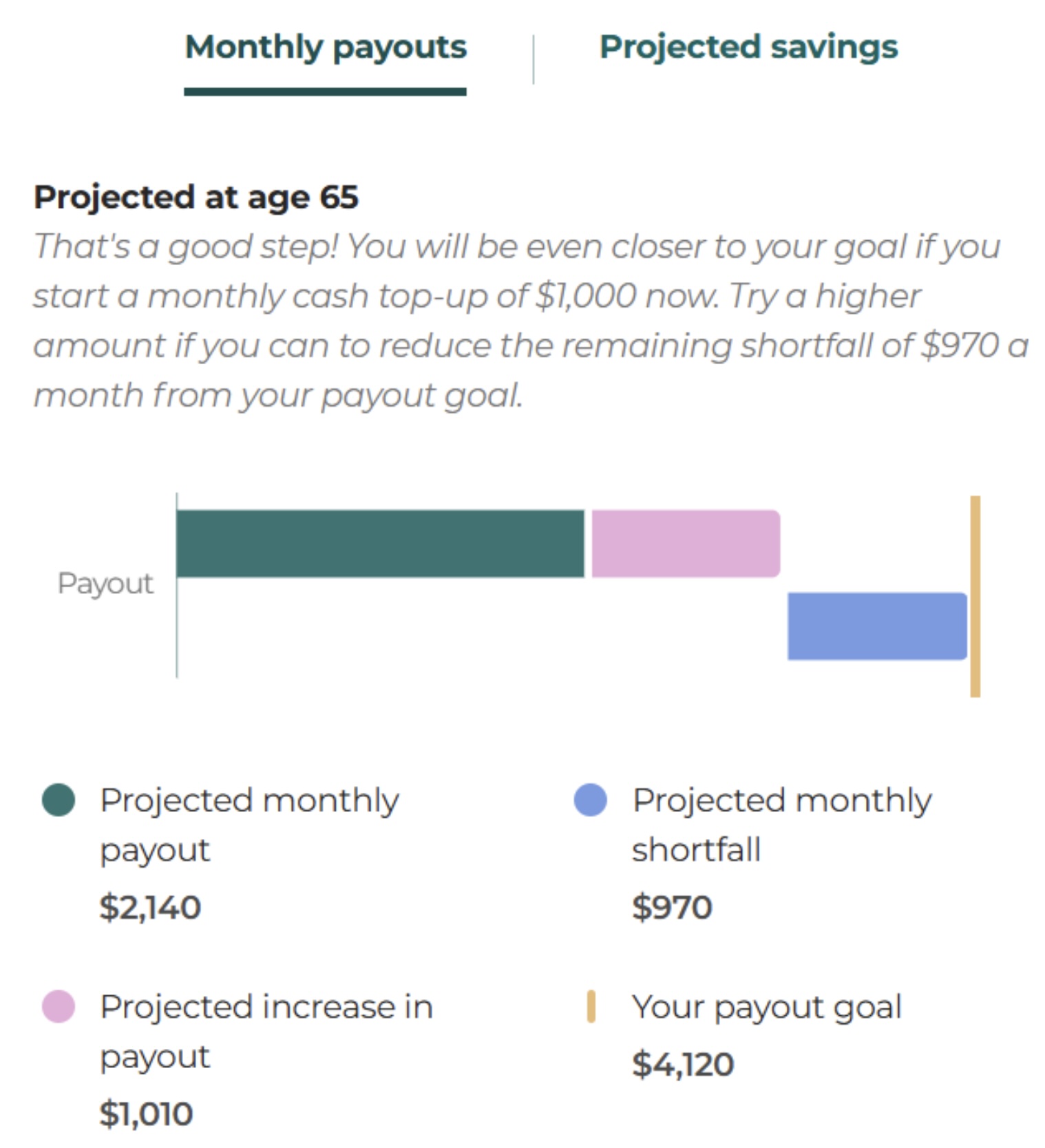

You can also use the planner to simulate actions such as cash top-ups or CPF transfers, and see how they can increase your payouts.

When I logged in with Singpass, I was pleasantly surprised by how simple it was to use.

The prompts were clear, and within minutes I could see projections based on my actual CPF balances.

For the first time, I felt confident that I had concrete numbers to work with instead of rough estimates!

Having these projections gave me a clear reliable starting point, making planning feel more manageable and less overwhelming.

Here’s how the planner helped me shape my retirement plan.