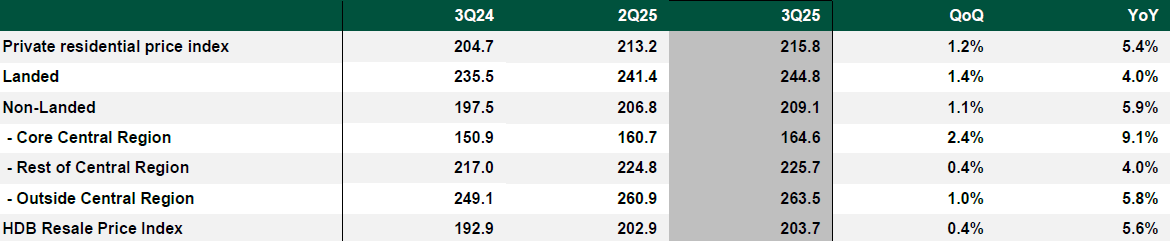

Private residential prices rose 1.2% in 3rd Quarter 2025

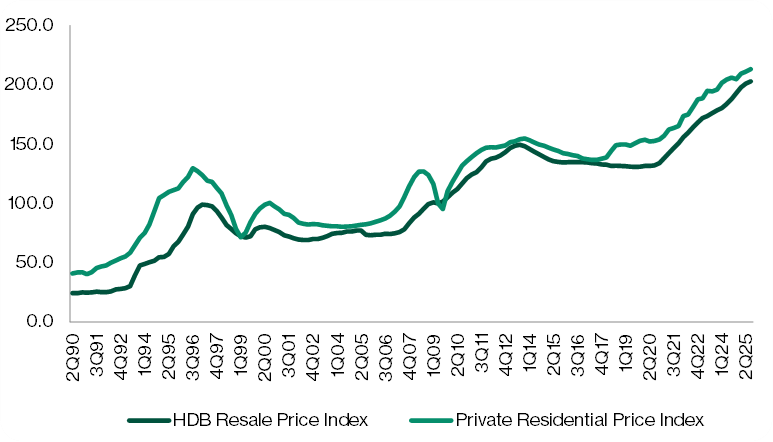

Private residential price index rose 1.2% Quarter-On-Quarter (QoQ) in 3Q25, representing a marginal pick-up from the 1.0% QoQ increase in 2Q25.

On a Year-On-Year (YoY) basis, private residential prices rose 5.4% in 3Q25.

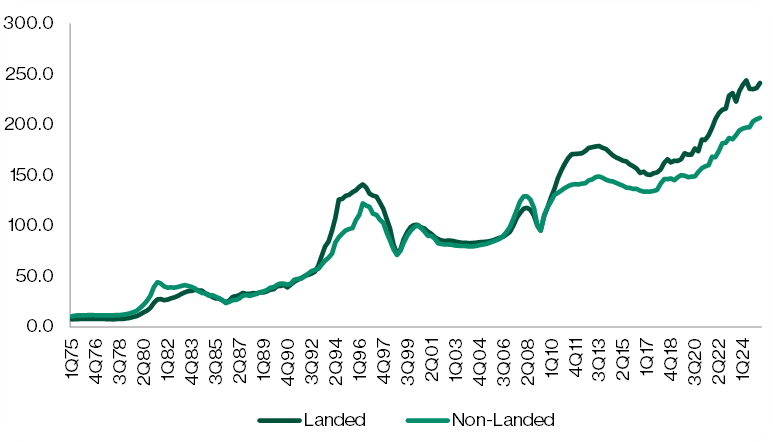

This quarter’s private residential price increases were led by both landed and non-landed properties which rose 1.4% QoQ and 1.1% QoQ, respectively.

This is a reversal from the trend in 2Q25 where prices were led by landed properties.

The QoQ increase in HDB resale prices continued to ease, with 3Q25 prices up 0.4% QoQ, the smallest quarterly price increase since 2Q20.

On a YoY basis, HDB resale prices have continued to outpace that of private residential prices, with a 5.6% YoY increase.

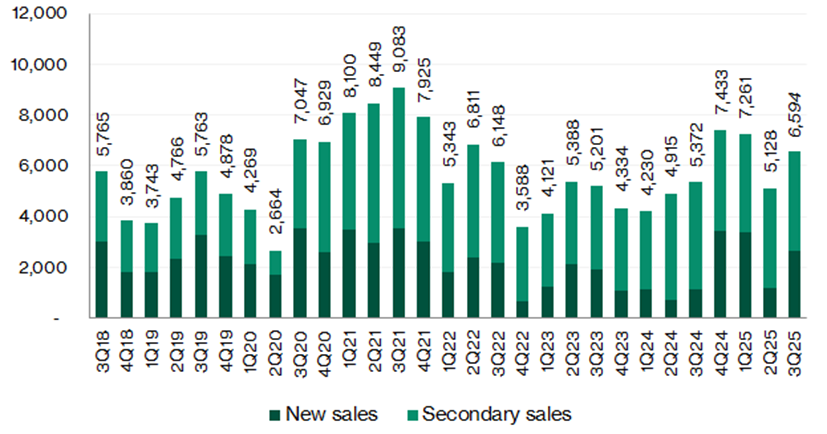

HDB resale volume was 7,157 in 3Q25, -10.9% YoY.

In October 2025, HDB will launch the final sales exercise for the year, offering more than 9,000 Build-To-Order (BTO) flats in Ang Mo Kio, Bedok, Bishan, Bukit Merah, Jurong East, Sengkang, Toa Payoh and Yishun. This includes HDB’s fifth Community Care Apartment (CCA) project in Sengkang.

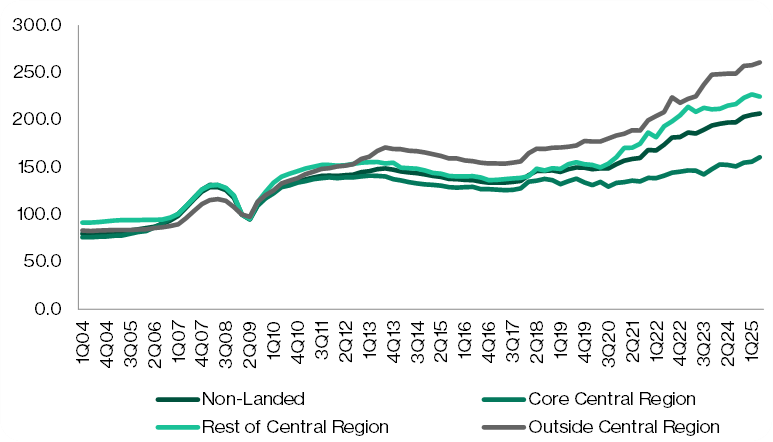

Across the private residential non-landed subsegments, 3Q25 prices were led by a standout performance at the Core Central Region (CCR) with a 2.4% increase, followed by Outside Central Region (OCR) at 1.0% QoQ and the Rest of Central Region (RCR) saw a 0.4% QoQ increase.

The moderation in the RCR was likely due to pricing at new launches like Lyndenwoods (336 units sold at a median price of $2,462 psf).

On the other hand, volume and prices in CCR were driven by three key projects which sold total of 835 units – Robertson Opus (169 units sold at $3,356), Upperhouse at Orchard Boulevard (202 units sold at $3,304) and River Green (464 units sold at $3,120). CCR recorded overall new home sales of 900 units in 3Q 2025, the highest quarterly CCR sales since 4Q 2010.

Robust price and volume increase

Despite record high launches in the city region, prices of non-landed properties in the CCR continued to climb steadily, increased by 2.4% QoQ in 3Q25, compared to 3.0% QoQ in 2Q25.

In the RCR and OCR segments, price increases at a more measured pace, +0.4% QoQ and +1.0% QoQ, respectively.

Recovering from a cautious sentiment in 2Q25 amid US-Liberation Day and Middle East tensions, there was a significant pick up in new launches in 3Q25.

There were nine new private residential projects launched in 3Q25, compared to five major private residential projects launched in 2Q25.