DO THESE SAFEGUARDS REMOVE PERSONAL AGENCY?

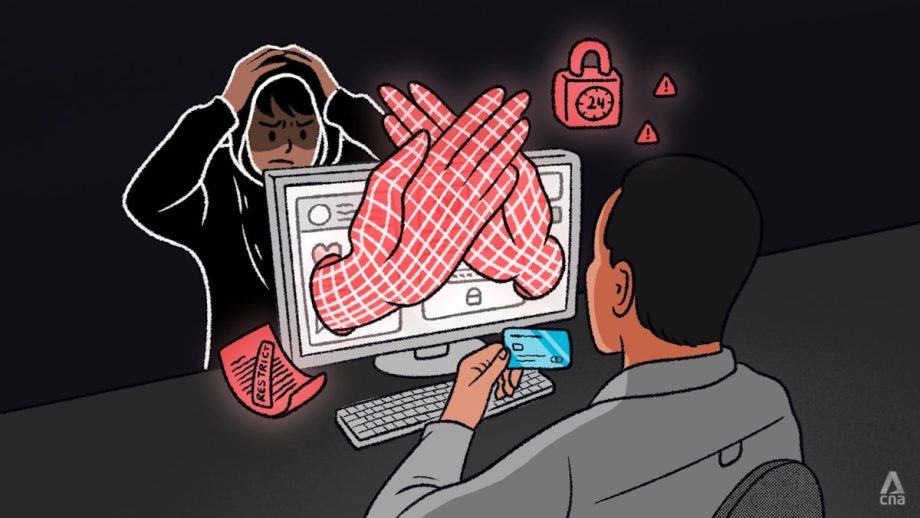

While authorities and banks see a clear-cut need for such measures to combat scams and monetary losses, the laws protecting potential scam victims have sparked debate over whether financial institutions and the police are being given too much control over people’s money.

Some countries have employed similar tactics, much to the dissatisfaction of citizens.

In Thailand, the cyber police announced in September that they would revise the criteria for freezing bank accounts after a public outcry from people whose accounts were locked despite having no links to scams.

The country’s Cyber Crime Investigation Bureau said it had received numerous complaints from vendors and citizens who found their accounts frozen even though they had not allowed their accounts to be used as mule accounts.

In Singapore, despite the public consultation and news articles on the proposed framework, many were still caught off guard by the new powers given to banks and authorities.

Associate Professor Hannah Yee-Fen Lim from NTU said it was likely that the consumers may have had “big picture knowledge” of the consultations, but may not be aware of the minute details.

When the Protection of Scams Bill was debated in Parliament in January, some Members of Parliament (MPs) reflected these concerns.

Member of Parliament for Yio Chu Kang SMC, Mr Yip Hon Weng, said that while the measures were necessary and a timely step to address the scam crisis, it is also “highly intrusive” because it “removes personal agency” by restricting access to accounts.

Mr Gerald Giam, Workers’ Party MP for Aljunied GRC, similarly said that while the Bill is an important step towards “combating this scourge”, it introduces a significant change to the legal relationship between banks and their customers.