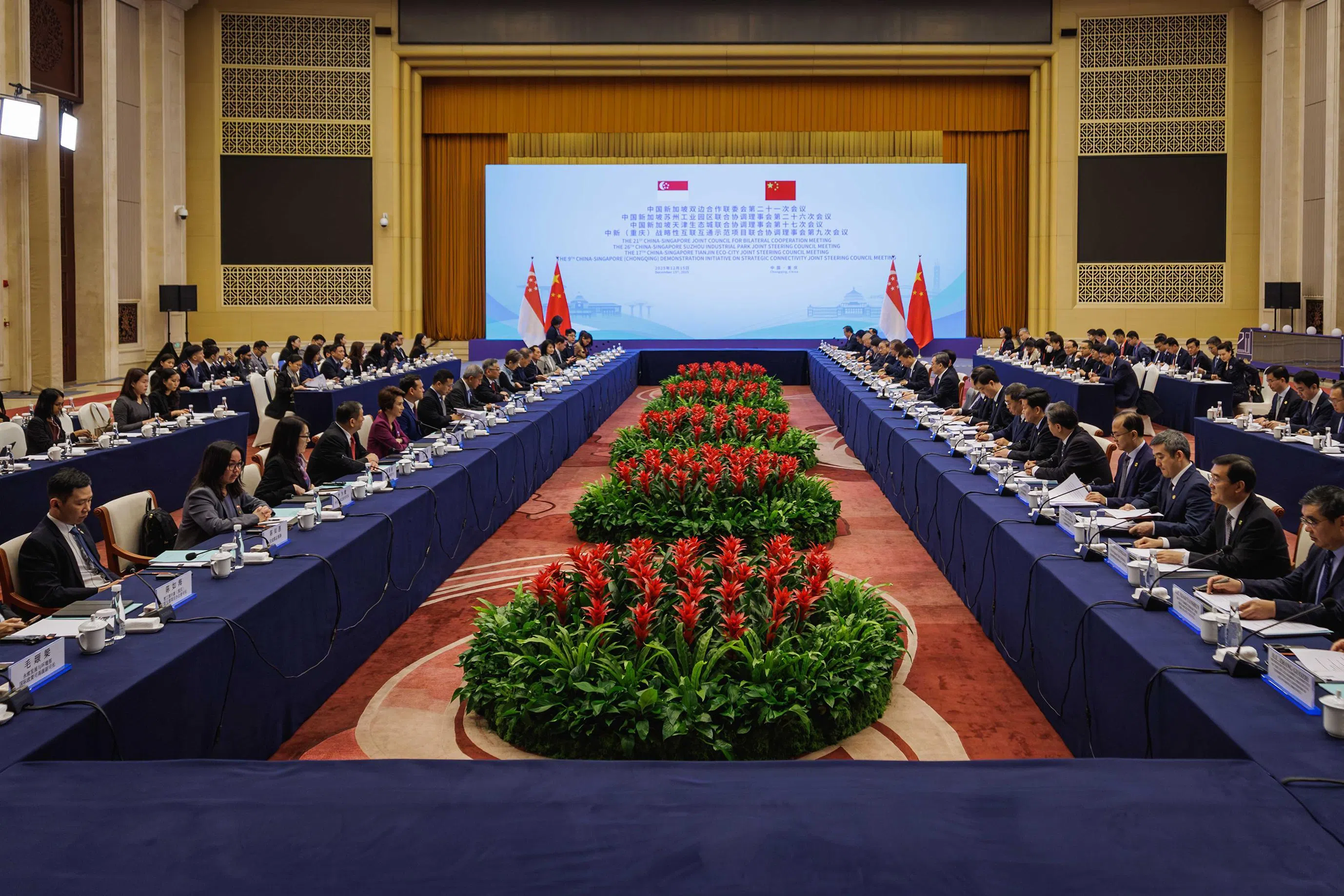

CHONGQING – Singapore and China announced a record 27 deals after top-level talks on Dec 15, including a pilot scheme to let Singaporean tourists use digital renminbi in China.

The new deliverables, spanning sectors from health and food to the digital economy, come as both countries call for deeper and broader ties amid geopolitical uncertainties, rapid technological changes and economic headwinds.

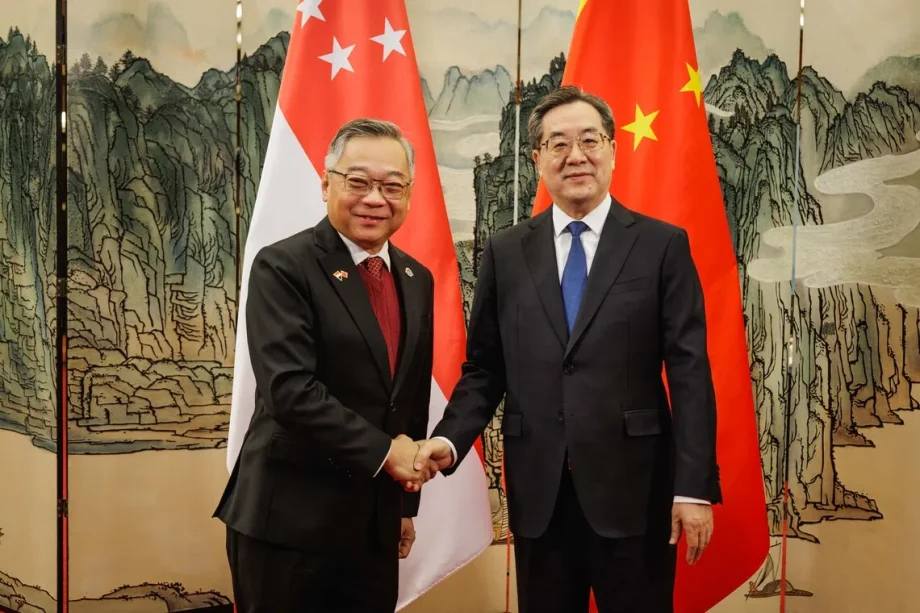

Against this backdrop, “it is therefore all the more important for Singapore and China to continue to find ways to cooperate, anticipating challenges and capitalising on new opportunities,” said Deputy Prime Minister Gan Kim Yong, speaking at the Joint Council for Bilateral Cooperation (JCBC), the apex bilateral platform.

Chinese Vice-Premier Ding Xuexiang, who is Mr Gan’s co-chair for the JCBC, said in his opening remarks that despite rising global unilateralism, the relationship between China and Singapore had grown steadily, with cooperation yielding fruitful results.

He noted that trade between the two countries in the first 11 months of 2025 grew 8.8 per cent from a year earlier, while the number of flights between Singapore and China has also exceeded pre-Covid-19 levels.

The annual JCBC and related meetings are being held 2025 in the south-western Chinese city of Chongqing to mark the 10th anniversary of the China-Singapore (Chongqing) Demonstration Initiative on Strategic Connectivity (CCI). It is a bilateral collaboration platform aimed at strengthening connectivity between western China and South-east Asia.

After nearly three hours of talks, both leaders witnessed the announcement of the 27 memorandums of understanding (MOUs) and agreements.

Five of the documents set out plans for the CCI’s next decade, extending cooperation to new areas such as healthcare, education, green finance and digital trade, while building on its four initial areas of collaboration – financial services, aviation, transport and logistics, and information and communications technology.

Under one of the agreements announced, DBS Bank was named Singapore’s second renminbi clearing bank, after the Singapore branch of the Industrial and Commercial Bank of China (ICBC).

DBS Bank China chief executive Ginger Cheng told The Straits Times that being part of the CCI has helped the bank expand its share of China’s offshore bond market, including issuing the first offshore renminbi bond under the initiative.