What happened?

Singapore stocks have performed well in 2025.

Earlier this week, we looked at the 3 top-performing Singapore blue-chip REITs in 2025 as well as the 3 SGX-listed REITs that have outperformed in the wider S-REIT market.

With the launch of the iEdge Singapore Next 50 Index, we see growing attention in the mid-cap stocks beyond Singapore REITs and the blue-chips.

Among the iEdge Singapore Next 50 Index constituents, there are several that saw gains of more than 100%.

In this article, we take a closer look at the five best-performing iEdge Singapore Next 50 stocks year-to-date, and examine whether their dividend yields are as attractive.

The 5 Best Performing iEdge Singapore Next 50 Stocks in 2025

#1 – Hong Leong Asia (SGX: H22)

Hong Leong Asia is the trade and industry arm of the Hong Leong Group.

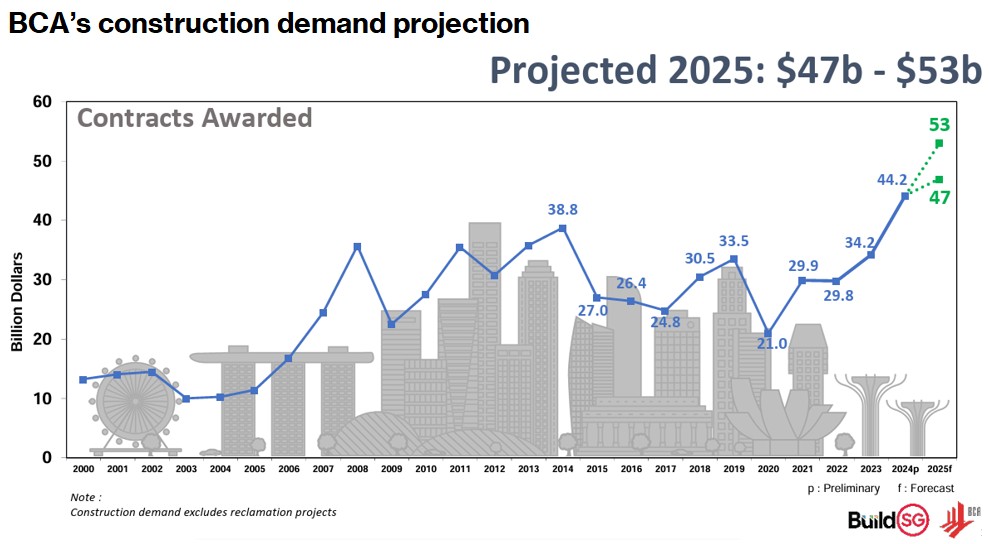

It operates as a diversified Asian multinational with core businesses in powertrain solutions through its subsidiary China Yuchai International, and building materials such as cement, precast concrete, and ready-mix concrete in Singapore and Malaysia.

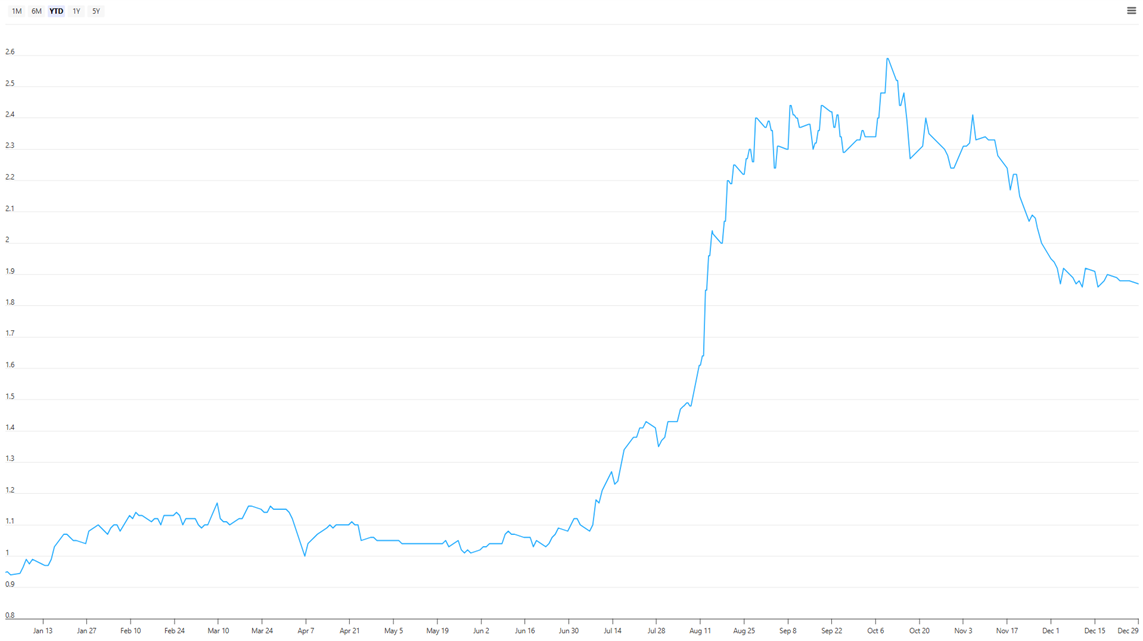

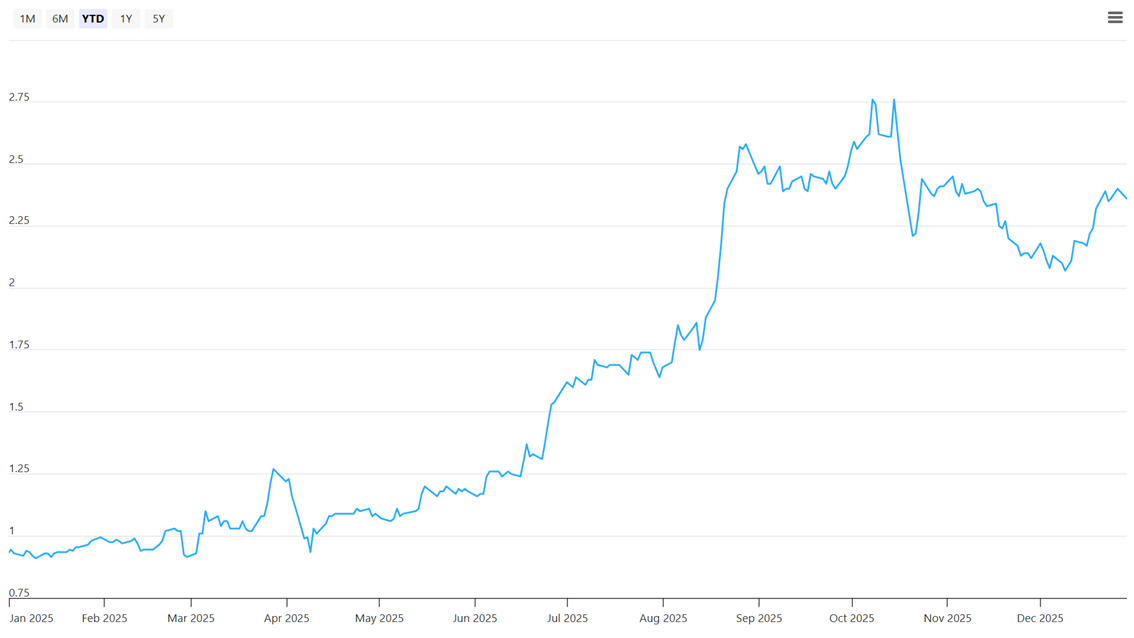

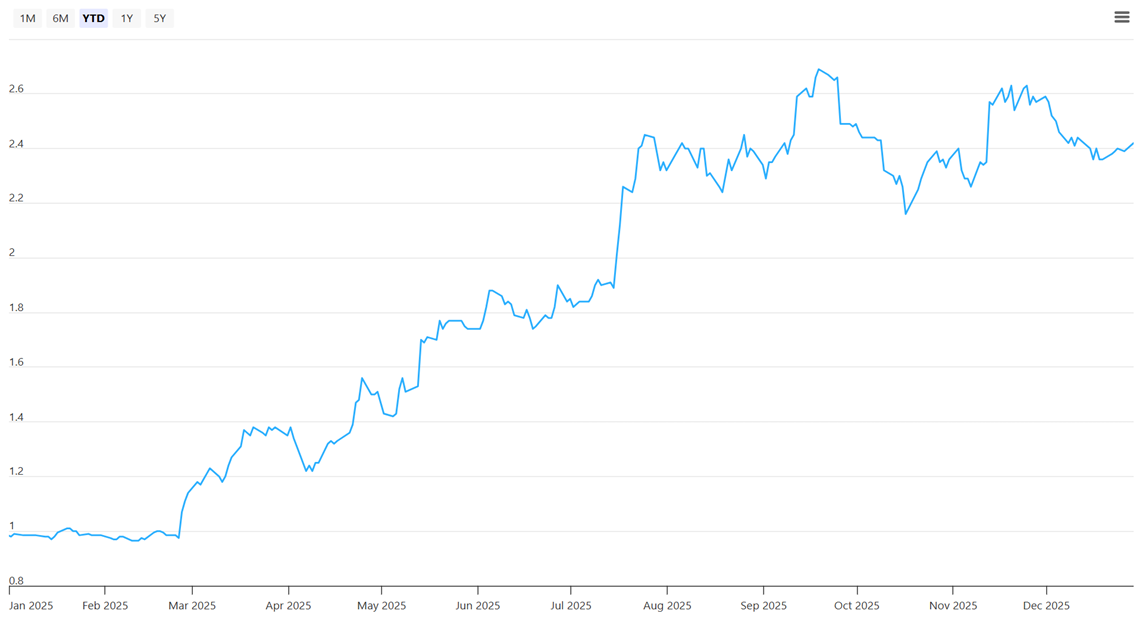

Coming in first place, Hong Leong Asia share price has rallied approximately 159.3% year-to-date as of 29 December 2025.

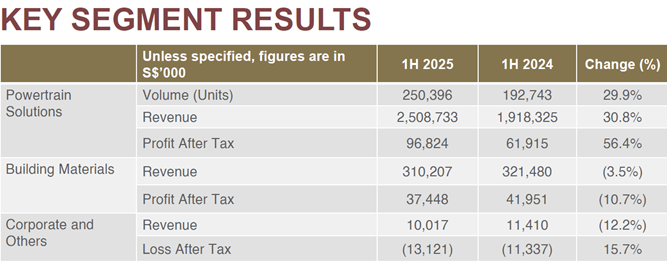

For the first half ended 30 June 2025 (1H2025), Hong Leong Asia reported a 13.1% year-on-year increase in net profit attributable to owners (PATMI) to S$56.1 million.

Revenue rose 25.7% to S$2.83 billion, driven primarily by the powertrain solutions division, which saw sales surge as the commercial vehicle market in China recovered.

Group gross profit expanded 18.5% to S$427.5 million, though gross margin moderated to 15.1% (from 16.0%) due to product mix and RMB weakness.

Profit before tax jumped 31% YoY to S$121 million, driven by volume growth and operating efficiencies at Yuchai.

Net profit attributable to shareholders (PATMI) was S$56.0 million (+13.1% YoY). Excluding a one-off associate gain in 1H 2024, core PATMI rose 21.2% YoY.

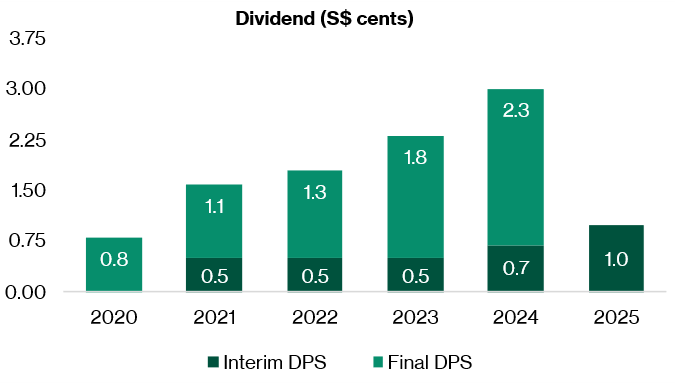

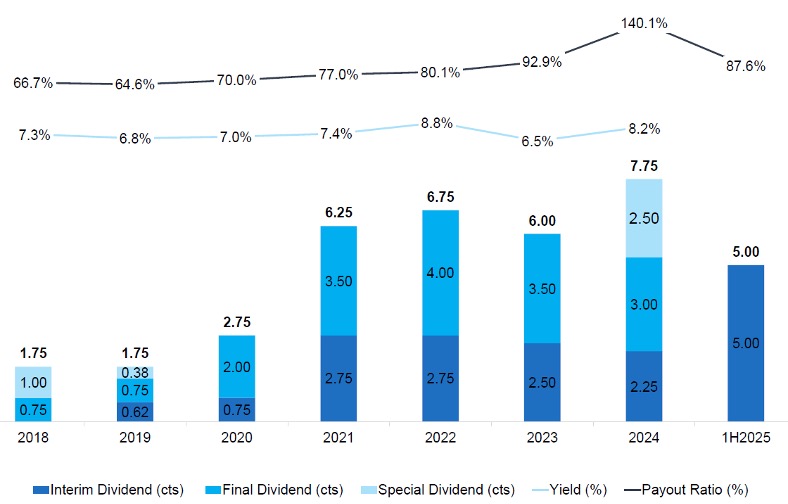

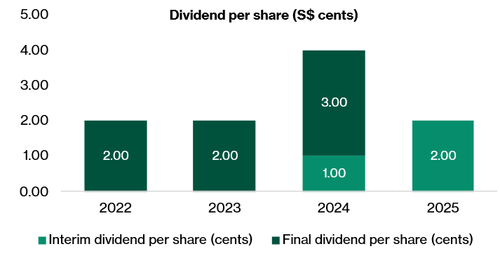

The company doubled its interim dividend from S$1.0 cents in 1H FY2024 to S$2.0 cents per share for 1H FY2025.

The company maintains a solid balance sheet with a net cash position, supported by disciplined capital management and improving visibility on margin expansion across its key business segments.

Related links:

#2 – Food Empire Holdings (SGX: F03)

Food Empire is a global branding and manufacturing company in the food and beverage sector.

Its portfolio includes instant coffee, confectionery, and snacks, with leading brands like MacCoffee.

The Group has a strong presence in markets such as Russia, Ukraine, Kazakhstan, Commonwealth of Independent States (CIS) countries, and Southeast Asia.

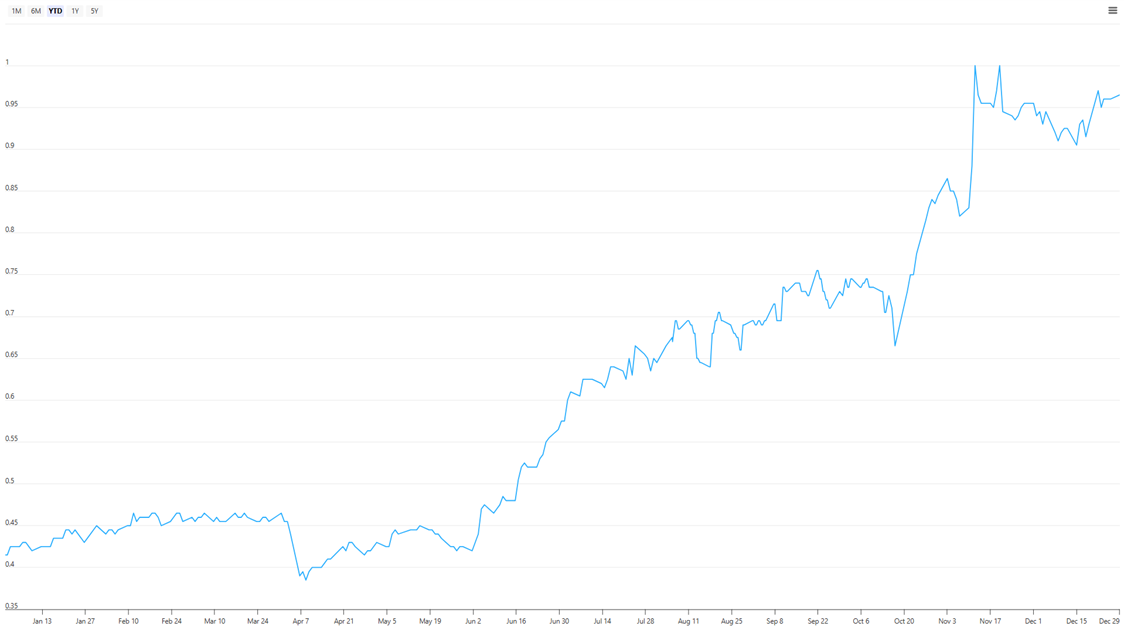

Food Empire Holdings has climbed approximately 144.4% year-to-date as of 29 December 2025, taking the second spot.

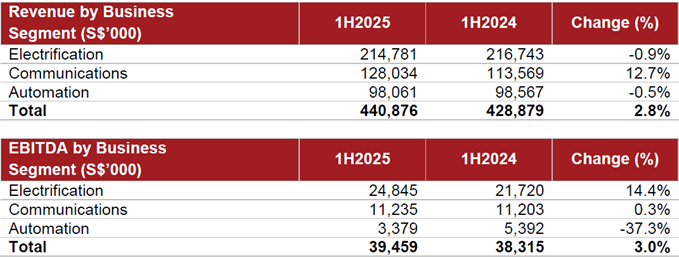

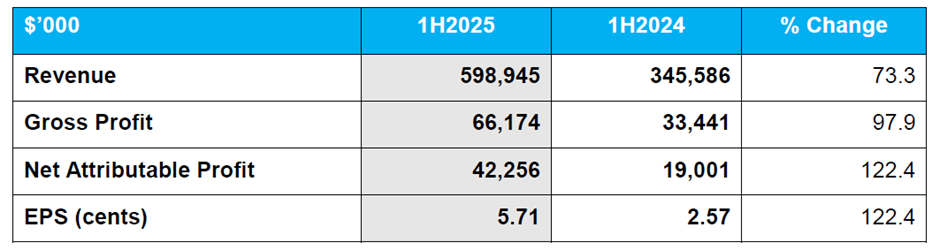

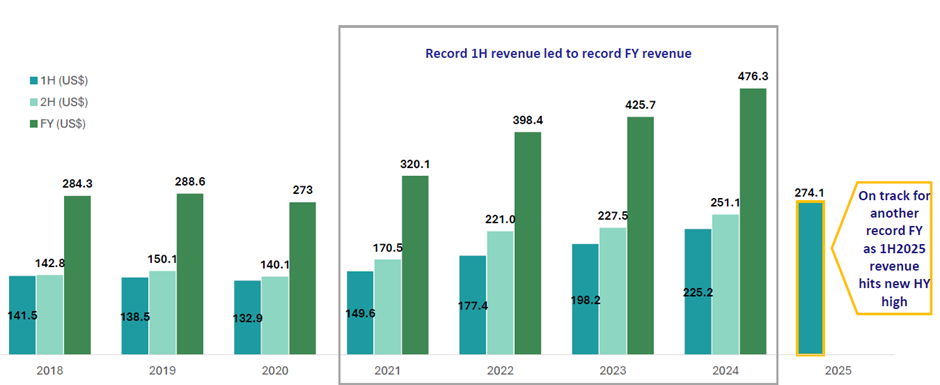

For 1H2025, Food Empire achieved record revenue of US$274.1 million, a 21.7% increase from the previous year.

Growth was broad-based, with the Southeast Asia segment recording the highest growth of 25.3% rise in revenue for 1H2025.

While reported net profit was impacted by a one-off non-cash fair value loss, normalised net profit grew 35.7% to US$31.5 million.

In its 3Q2025 business update, the Group reported that revenue jumped 28.3% to US$152.6 million, driven by a particularly strong quarter in its Russia and CIS segments.

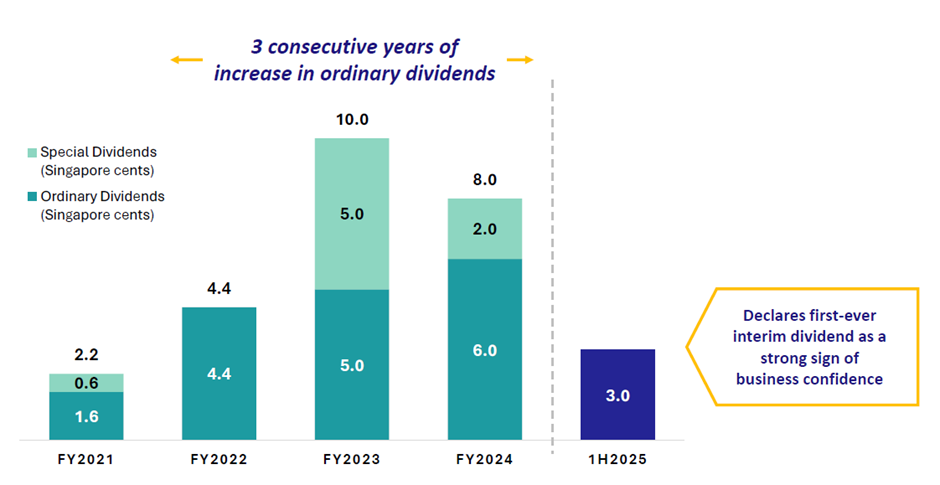

In a sign of confidence, the company declared its first-ever interim dividend of 3.0 Singapore cents in 1H2025.