What happened?

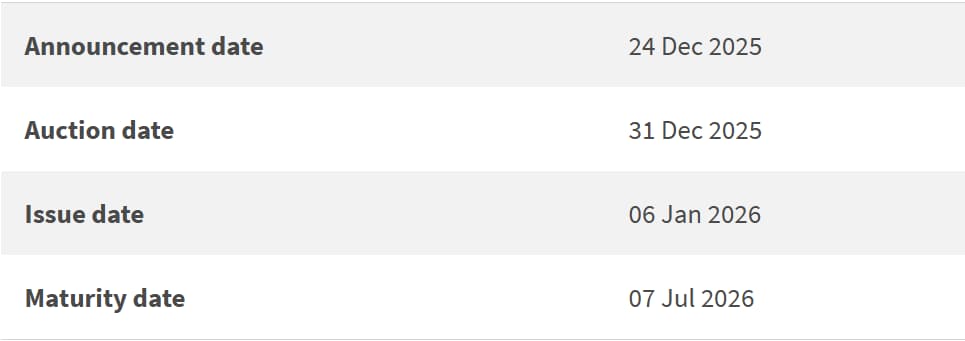

The next 6-month Singapore T-bill auction (BS26100A) will be on 31 December 2025.

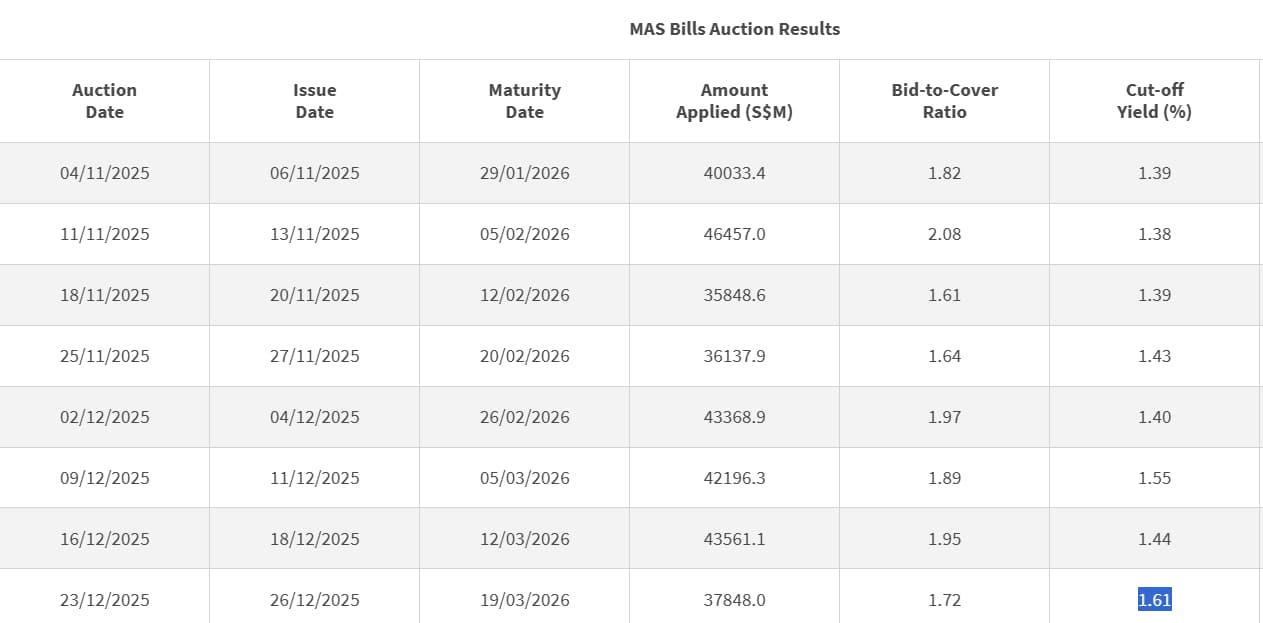

In the most recent auction on 18 December, the cut-off yield for the 6-month Singapore T-bill bounced to 1.48% from 1.41% in the previous auction.

This led to renewed interest in the Singapore T-bill, with questions in the Beansprout community about whether we will se a further increase in the T-bill yield in the upcoming auction.

In this article, I’ll look at some of the latest indicators to help us understand what the upcoming cut-off yield might be, and if it will still be worthwhile applying for T-bills as a way to generate passive income.

Here’s what to expect for the Singapore T-bill auction on 31 December

#1 – US 10-year government bond yields remains steady

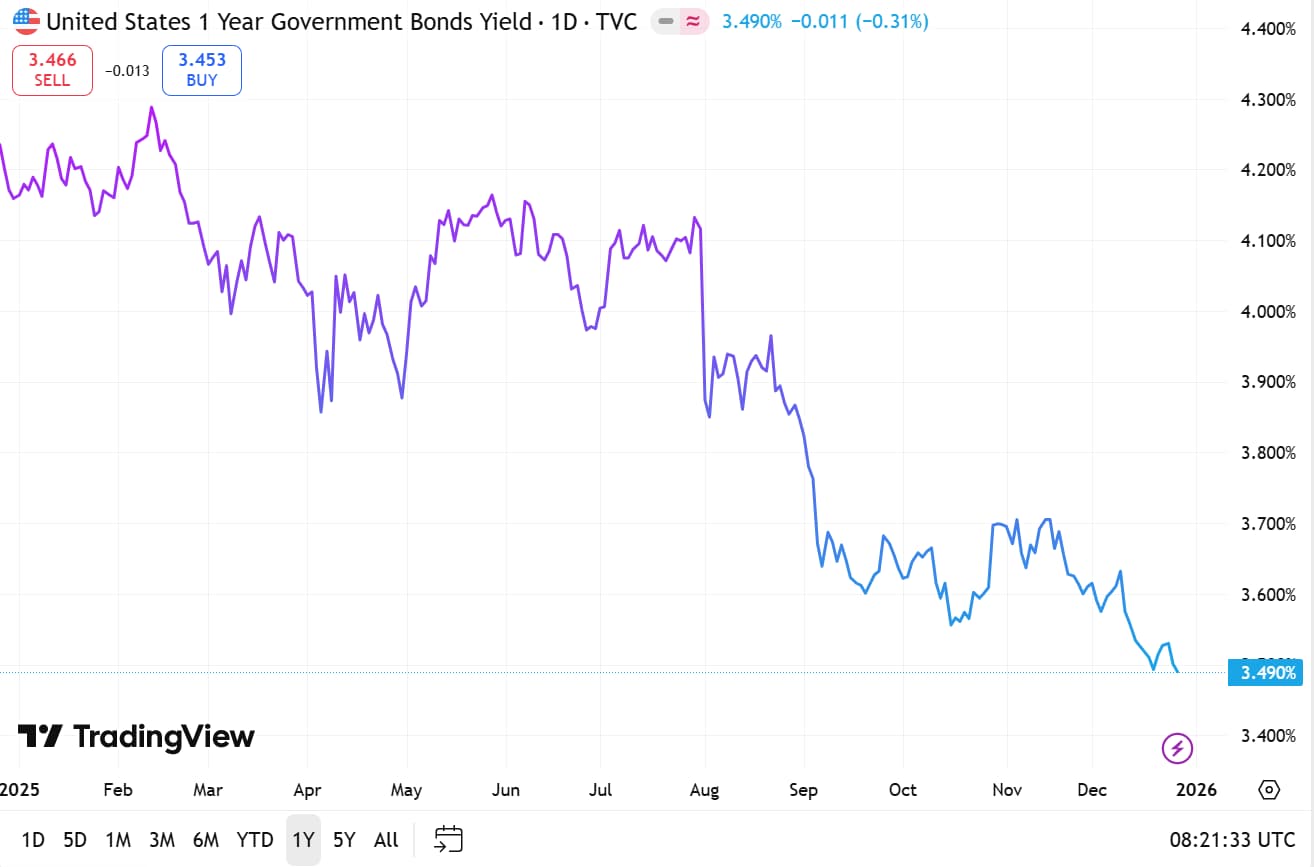

The 10-year US government bond yield was at 4.13% as of 27 December 2025, close to the yield of 4.19% from two weeks ago.

US government bond yields appeared to have stabilised, after the Fed cut rates as expected in its December meeting.

The 1-year US government bond yield was at 3.49% as at 13 December 2025, also close to 3.53% from two weeks ago.

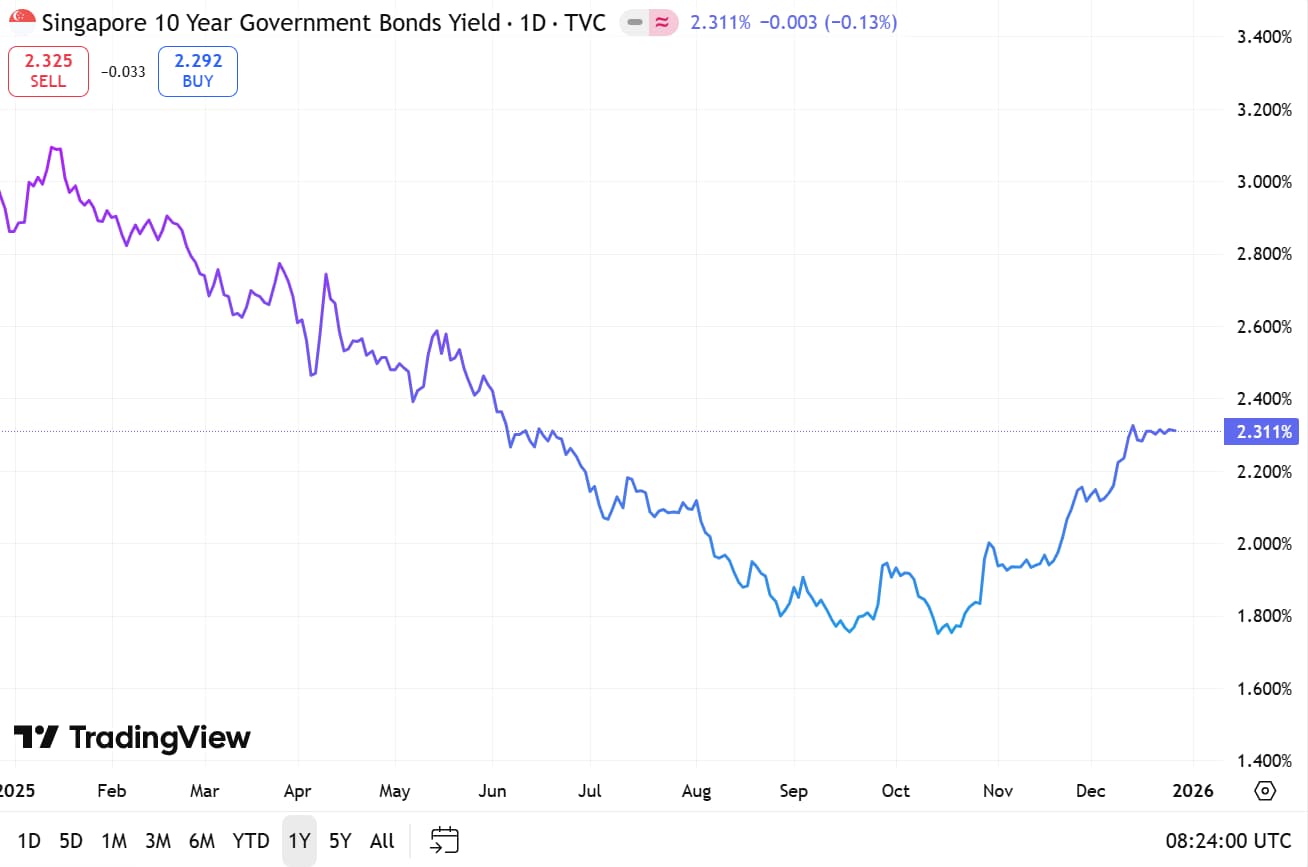

#2 – Singapore government bond yields remains steady

The 10-year Singapore government bond yield was at 2.31% as of 27 December 2025, similar to 2.33% from two weeks ago.

This is consistent with the stabilisation in US 10-year government bond yields in recent weeks.

The closing yield on the 6-month T-bill was 1.45% on 26 December 2025, close to the cut-off yield of 1.48% in the previous T-bill auction on 18 December.