What happened?

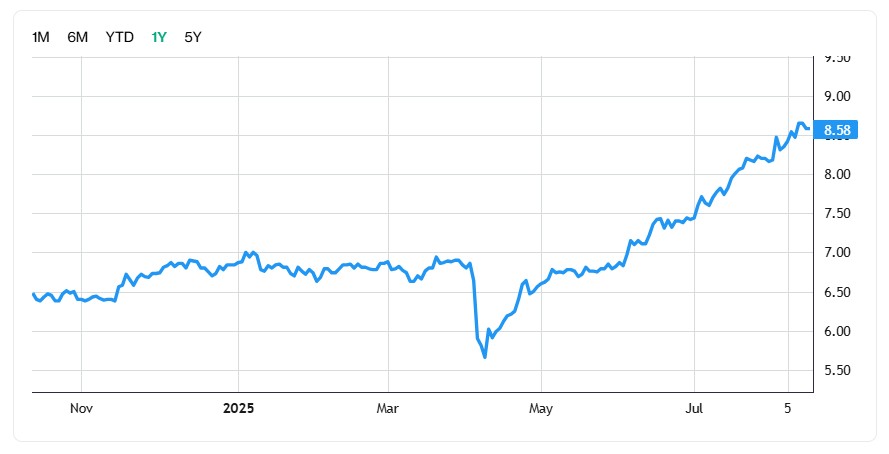

Singapore’s stock market has been on a strong upward trend.

The Straits Times Index (STI) continued its rally in October 2025, and recently reached a new record high of above 4,400.

Just two weeks ago, I highlighted 3 Singapore REITs with dividend yields of above 5% and 3 Singapore blue chip stocks with dividend yields of above 5%.

More recently, I’ve noticed several blue-chip counters hitting new all time highs, and there’s been growing discussion within the Beansprout community about these stocks.

In this article, we will look at four Singapore blue chip names that are nearing new highs and find out if they continue to offer attractive dividends yields.

4 Singapore blue chip stocks near record highs. Are dividends still attractive?

#1 – DBS Group Holdings (SGX: D05)

DBS is Singapore’s largest bank by market capitalisation and offers a comprehensive range of banking, insurance, and investment services to both individuals and corporations.

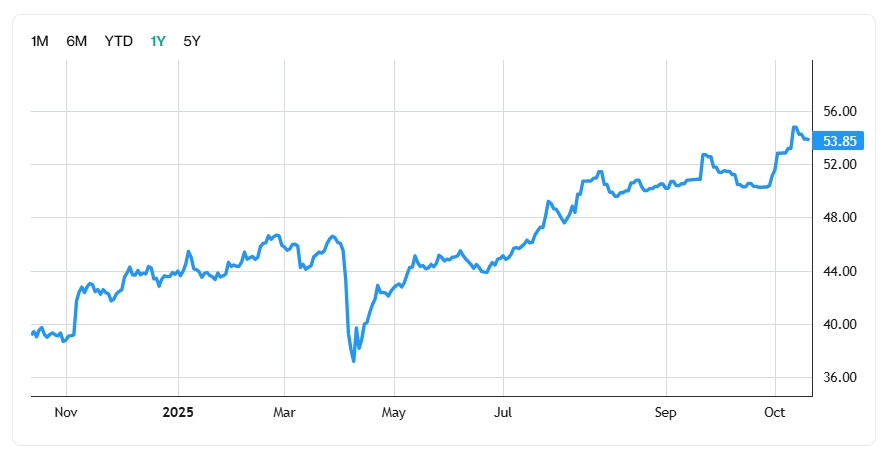

With a 23% gain year-to-date, DBS’ shares recently hit a new all time high of S$54.80.

DBS also became the first company in Singapore to exceed S$150 billion in market capitalisation.

DBS reported steady profit growth in 2Q 2025, with net profit rising around 1% year-on-year to S$2.82 billion, while 1H 2025 net profit was largely flat at S$5.72 billion.

Their total income grew around 5% year-on-year on the back of strong fee income, treasury customer sales and improved markets trading.

The bank maintained a return on equity of 17%, reflecting continued efficiency in capital deployment.

While net interest income stabilised as funding costs remained elevated, non-interest income provided an important boost.

Management guided that non-interest income and fee-related businesses will remain key earnings drivers as interest margins stabilise.

Overall, DBS continues to demonstrate earnings resilience and consistent shareholder returns.

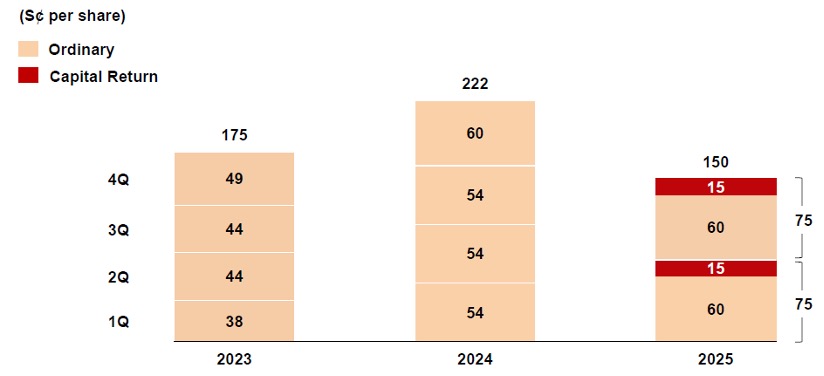

DBS declared an ordinary dividend of S$0.60 per share for 2Q 2025 and a special capital return dividend of S$0.15, bringing total 1H 2025 dividends to S$1.50 per share.

Annualising the quarterly dividend payout of S$0.75 per share translates to a dividend yield of about 5.5%, based on the current share price of S$54.08.

This remains above DBS’s historical average dividend yield of 5.0%.

Find out how much dividends you can potentially receive as a shareholder of DBS Group Holdings Ltd with the calculator below.

Related Links:

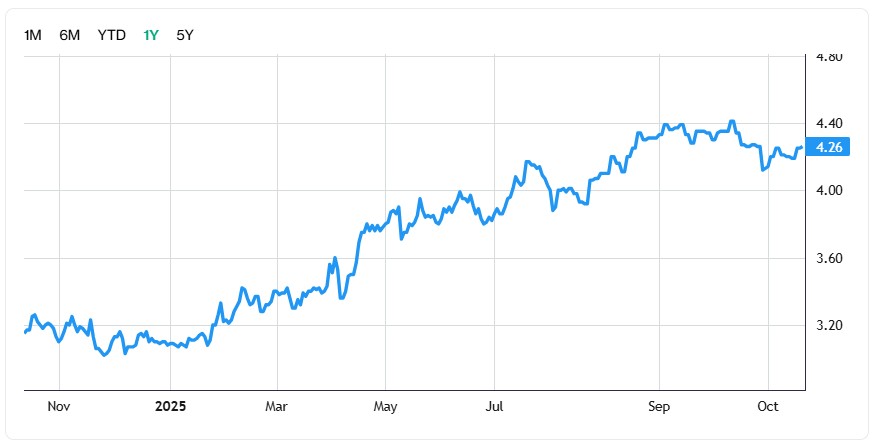

#2 – ST Engineering (SGX: S63)

Singapore Technologies Engineering, or ST Engineering, is a technology and engineering firm that serves the aerospace, smart city, and defence sectors.

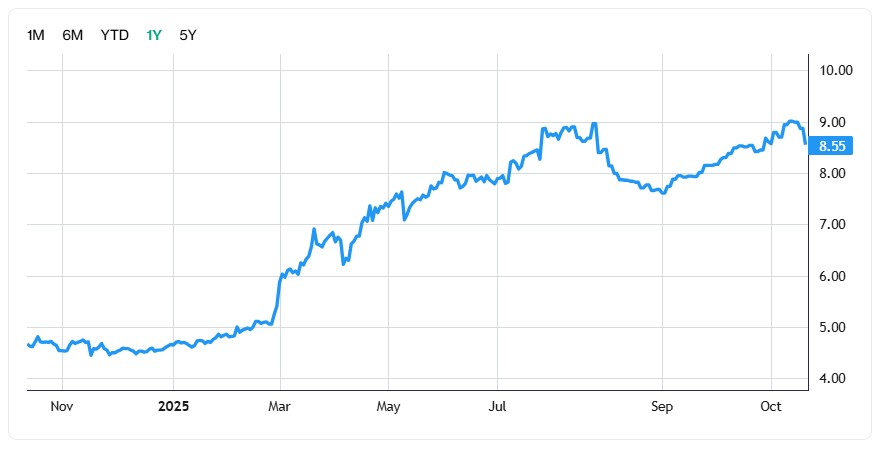

With a gain of 93.3% year-to-date, ST Engineering’s shares recently hit an all time high of S$9.03.

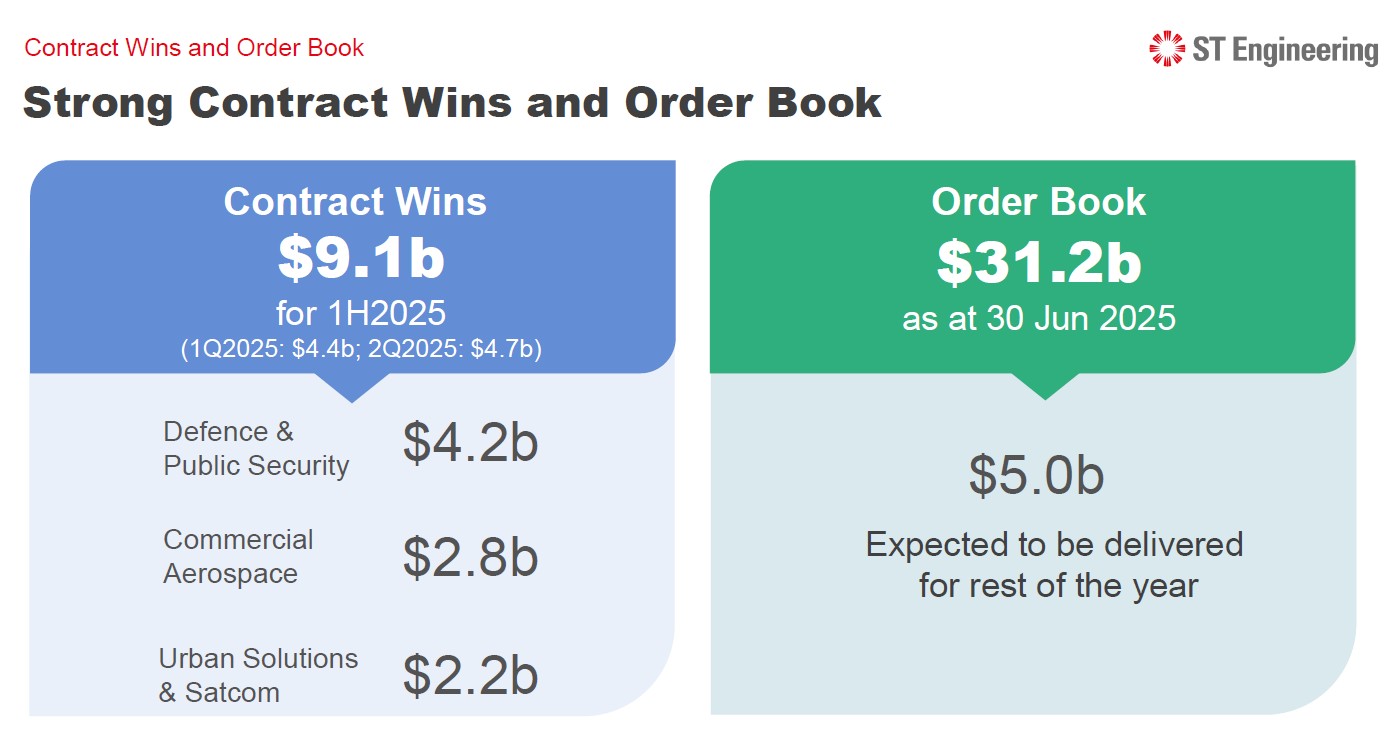

ST Engineering reported a robust performance in the first half of 2025, supported by broad-based growth across its key segments.

1H2025 revenue climbed 7% year-on-year to S$5.9 billion, with all three of the group’s segments recording year-on-year revenue growth.

The Defence & Public Security (DPS) segment contributed the largest share of growth with a 12% increase in revenue to S$2.6 billion and a 13% rise in EBIT to S$367 million.

The Commercial Aerospace division also performed steadily, with revenue up 5% to S$2.35 billion and EBIT up 18%, reflecting higher engine maintenance, repair and overhaul (MRO) activity and cost efficiencies.

It is also investing in new infrastructure, including a greenfield airframe maintenance facility in Ezhou, China.