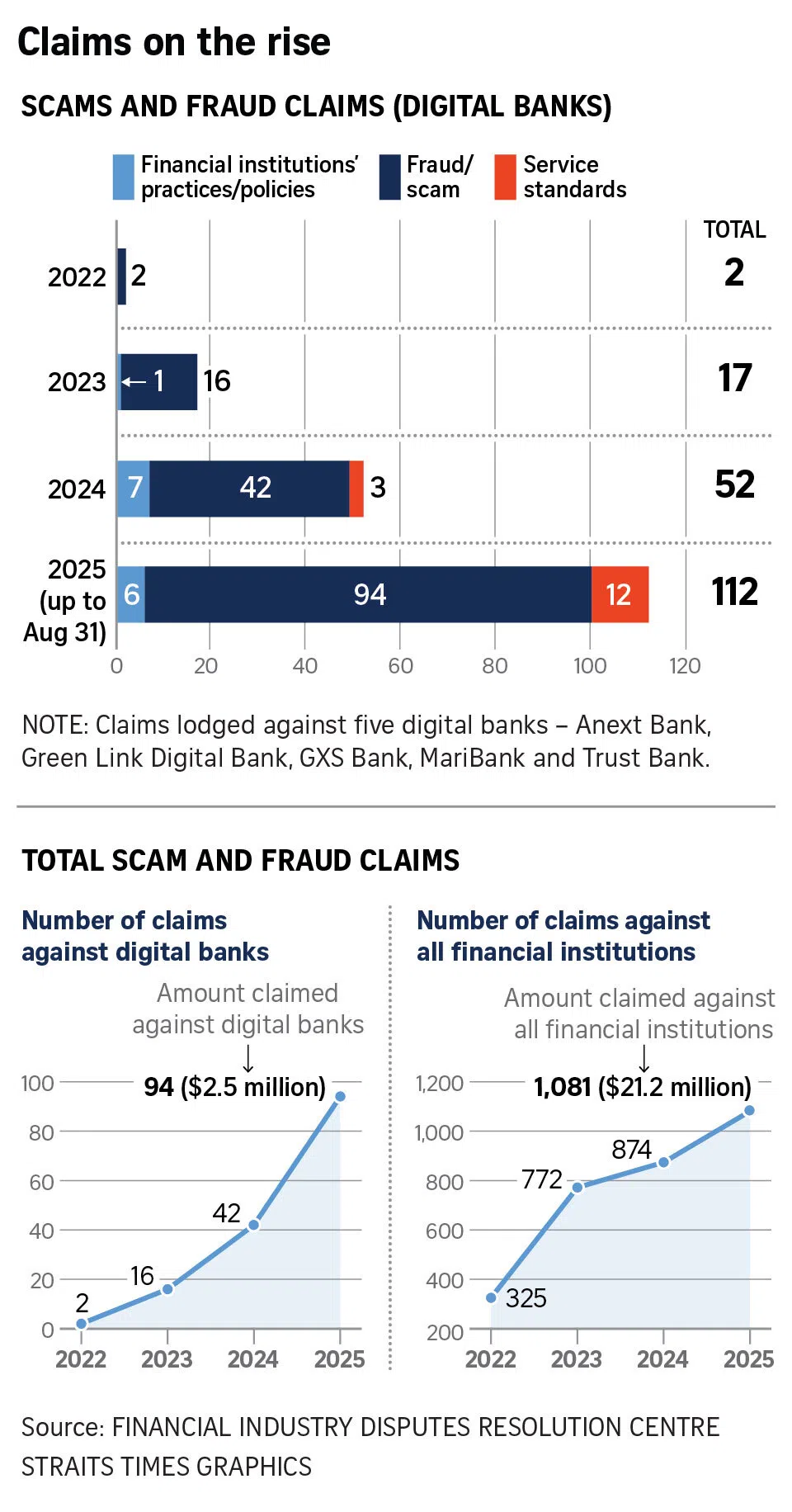

SINGAPORE – There were 94 scam and fraud claims against digital banks in Singapore in the first eight months of 2025, more than double the 42 claims for the whole of 2024.

The total monetary amount for these 94 claims was $2.5 million, the Financial Industry Disputes Resolution Centre (Fidrec) said in response to queries from The Straits Times.

Fidrec said the most common cases it has handled involved compromised credentials and impersonation scams.

In cases of compromised credentials, a victim’s login information is stolen via phishing and malware. Scammers then use the information to access bank accounts and e-wallets to siphon off the funds.

As for impersonation scams, scammers pose as authority figures such as bank and government officials, or friends and family. They then persuade their victims to transfer money to them.

The claims were lodged against five digital banks, said Fidrec. Three of them – Trust Bank, GXS Bank and MariBank – serve retail customers, while the other two – Anext Bank and Green Link Digital Bank – cater to micro, small and medium-sized enterprises.

GXS Bank commenced operations here in August 2022, Trust Bank followed a month later in September, and MariBank set up shop in March 2023.

For now, the scam and fraud claims against digital banks represent a small percentage of total claims against all financial institutions, but there is an increasing trend.

Fraud and scam claims against digital banks were 2.1 per cent of total claims in 2023. That proportion rose to 4.8 per cent in 2024, and 8.7 per cent as at Aug 31, Fidrec data showed.

The financial disputes resolution institution noted that scams and frauds made up the bulk – 84 per cent – of all claims against the digital banks.

The rest of the claims related to service standards (11 per cent) and their practices and policies (5 per cent).

Professor of information systems Jan Ondrus at Essec Business School said digital banks are fully online, and every interaction happens through their apps or websites.

He said scammers may therefore have more chances to trick customers with fake messages, phishing or impersonation attempts.

Furthermore, because digital banks have no branches, customers cannot speak with a bank officer in person, Prof Ondrus noted. He said the banks can make up for this with real-time fraud alerts and round-the-clock customer support.

Mr Christophe Barel, managing director for Asia-Pacific at the Financial Services Information Sharing and Analysis Centre (FS-ISAC), a cyber-security cooperative for banks, said banks, with or without branches, are susceptible to scams.

As most banking transactions are done online nowadays, neither model – digital only or digital with physical branches – is inherently safer or more exposed, he added.

Indeed, a vast majority of scams are successful because of the human element.

Mr Ashley Millar, consumer education director at cyber-security firm Trend Micro, noted that scammers recognise that people do not make rational decisions when they are stressed or tired.

They therefore exploit this vulnerability to make victims divulge confidential information or perform certain actions.

The proliferation of artificial intelligence and deepfakes has led to scams becoming increasingly sophisticated and harder to detect, Mr Millar said.

The banking industry, together with regulators and other stakeholders like the telcos, has stepped up the fight against scams.